Ever wondered about the best way to invest your hard-earned cash? It can feel like navigating a maze, right? Especially when you’re trying to decide between a mutual fund and an ETF.

Don’t sweat it! This guide breaks down the mutual fund vs ETF pros and cons explained, making your investment journey a whole lot clearer. We’ll explore each option’s strengths and weaknesses, so you can make the smartest choice for your financial future.

Understanding Mutual Funds

So, what exactly is a mutual fund? Think of it as a pool of money collected from many investors.

This pool is then managed by a professional fund manager who invests it in stocks, bonds, or other securities. The goal? To generate returns for the investors.

How Mutual Funds Work

Mutual funds operate by selling shares to investors. The price of a share, known as the Net Asset Value (NAV), is calculated at the end of each trading day.

The fund manager makes decisions about which assets to buy and sell, aiming to achieve the fund’s stated objectives. These objectives can range from aggressive growth to income generation.

Advantages of Mutual Funds

- Professional Management: You benefit from the expertise of a seasoned fund manager.

- Diversification: Mutual funds typically hold a wide range of assets, reducing risk.

- Accessibility: They are relatively easy to buy and sell through brokerage accounts.

- Variety: A vast array of mutual funds cater to different investment goals and risk tolerances.

- Convenience: Automatic investing options are often available.

Disadvantages of Mutual Funds

- Higher Expense Ratios: Management fees and other expenses can eat into your returns.

- Lack of Intraday Trading: You can only buy or sell shares at the end-of-day NAV.

- Potential for Tax Inefficiency: Frequent trading within the fund can trigger capital gains taxes.

- Limited Control: You have no direct say in the fund’s investment decisions.

- Minimum Investment Requirements: Some funds may require a minimum initial investment.

Exploring Exchange-Traded Funds (ETFs)

Now, let’s dive into ETFs. An ETF, or Exchange-Traded Fund, is similar to a mutual fund in that it holds a basket of assets.

However, unlike mutual funds, ETFs trade on stock exchanges like individual stocks.

How ETFs Work

ETFs are designed to track a specific index, sector, commodity, or investment strategy. Their prices fluctuate throughout the day based on supply and demand.

Investors can buy or sell ETF shares at any time the market is open, providing greater flexibility than mutual funds.

Advantages of ETFs

- Lower Expense Ratios: ETFs generally have lower fees compared to mutual funds.

- Intraday Trading: You can buy and sell shares throughout the trading day.

- Tax Efficiency: ETFs tend to be more tax-efficient due to their structure.

- Transparency: ETF holdings are typically disclosed daily.

- Flexibility: You can use various trading strategies, such as limit orders and stop-loss orders.

Disadvantages of ETFs

- Brokerage Commissions: You may incur commissions each time you buy or sell ETF shares.

- Potential for Tracking Error: An ETF may not perfectly track its underlying index.

- Market Volatility: ETF prices can be more volatile than mutual funds.

- Liquidity Concerns: Some ETFs with low trading volume may be difficult to buy or sell at desired prices.

- Not Actively Managed: Most ETFs are passively managed, meaning they simply track an index.

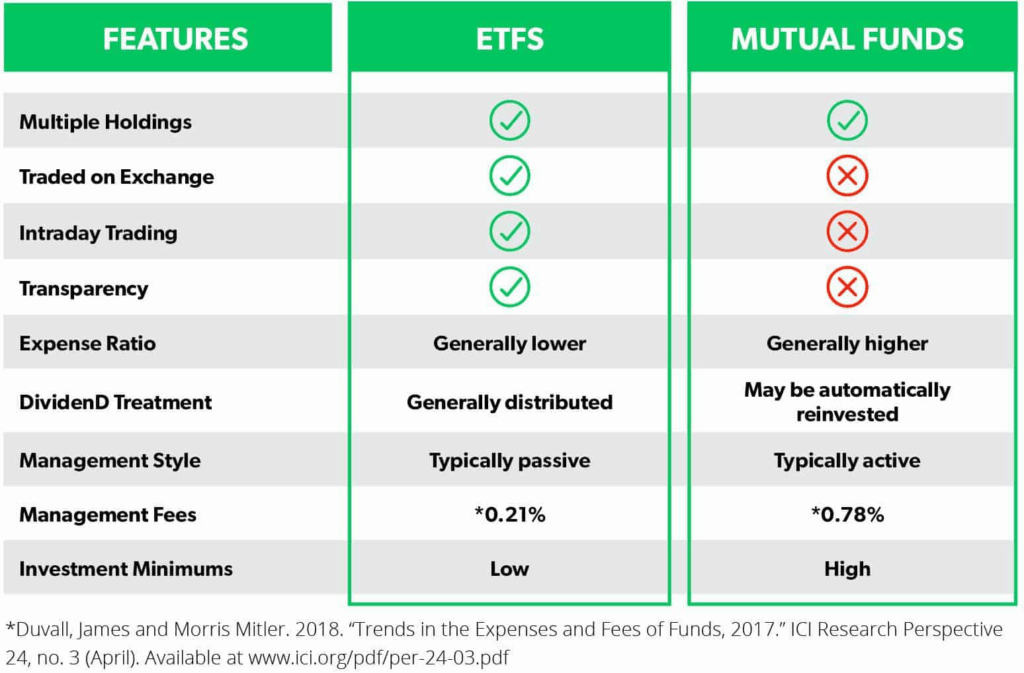

Mutual Fund vs ETF: A Detailed Comparison

Let’s break down the key differences between mutual funds and ETFs. This will help you see which one better aligns with your investment style and goals.

Cost and Fees

- Mutual Funds: Typically have higher expense ratios, including management fees, operating expenses, and potential sales loads (commissions).

- ETFs: Generally have lower expense ratios, but you may pay brokerage commissions on each trade.

Trading Flexibility

- Mutual Funds: Can only be bought or sold at the end-of-day NAV.

- ETFs: Trade on stock exchanges throughout the day, offering more flexibility.

Tax Efficiency

- Mutual Funds: Can be less tax-efficient due to frequent trading within the fund, potentially triggering capital gains taxes for investors.

- ETFs: Tend to be more tax-efficient due to their creation and redemption mechanism.

Investment Strategy

- Mutual Funds: Can be actively managed, with a fund manager making decisions to outperform the market, or passively managed, tracking a specific index.

- ETFs: Primarily passively managed, tracking an index, sector, or commodity.

Minimum Investment

- Mutual Funds: May have minimum initial investment requirements.

- ETFs: Can be purchased in single shares, making them accessible to investors with smaller amounts to invest.

Management Style

- Mutual Funds: Offer both active and passive management options.

- ETFs: Primarily offer passive management, aiming to replicate the performance of an index.

Choosing the Right Investment: Factors to Consider

Selecting between a mutual fund and an ETF depends on your individual circumstances. Here are some factors to keep in mind:

Investment Goals

What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or another long-term goal?

Risk Tolerance

How comfortable are you with the possibility of losing money? Are you a conservative, moderate, or aggressive investor?

Investment Time Horizon

How long do you plan to invest your money? A longer time horizon allows you to take on more risk.

Trading Frequency

Do you plan to actively trade your investments, or are you a buy-and-hold investor?

Tax Situation

Consider the tax implications of each investment option. ETFs tend to be more tax-efficient.

Investment Amount

How much money do you have to invest? ETFs can be more accessible with smaller amounts.

Real-World Examples: Mutual Fund vs ETF

Let’s look at some practical examples to illustrate the differences between mutual funds and ETFs.

Example 1: Long-Term Retirement Savings

Suppose you’re saving for retirement and have a long time horizon. You might consider a low-cost, diversified ETF that tracks a broad market index, such as the S&P 500. This provides broad exposure to the stock market with minimal fees.

Example 2: Actively Managed Growth

If you believe in a particular fund manager’s ability to outperform the market, you might choose an actively managed mutual fund focused on growth stocks. However, be prepared to pay higher fees for this active management.

Example 3: Tax-Advantaged Investing

For taxable accounts, ETFs can be a more tax-efficient choice. Their structure minimizes capital gains distributions, reducing your tax burden.

Example 4: Small Investment Amounts

If you’re just starting and have a small amount to invest, ETFs can be a good option. You can buy single shares of an ETF, whereas some mutual funds have high minimum investment requirements.

Strategies for Combining Mutual Funds and ETFs

It’s not an either/or situation! You can actually use both mutual funds and ETFs in your portfolio.

Core and Satellite Approach

Use low-cost ETFs as the core of your portfolio, providing broad market exposure. Then, add actively managed mutual funds as “satellites” to potentially enhance returns in specific sectors or asset classes.

Diversification Across Asset Classes

Use ETFs to gain exposure to various asset classes, such as stocks, bonds, and real estate. Then, use mutual funds to target specific investment strategies or themes.

Tax-Loss Harvesting

Use ETFs to implement tax-loss harvesting strategies. Sell ETFs that have declined in value to offset capital gains, while maintaining your market exposure.

Common Mistakes to Avoid

- Ignoring Fees: Don’t underestimate the impact of fees on your long-term returns.

- Chasing Performance: Past performance is not indicative of future results.

- Over-Diversification: Spreading your investments too thin can dilute your returns.

- Lack of Due Diligence: Research any fund or ETF before investing.

- Emotional Investing: Avoid making impulsive decisions based on market fluctuations.

Resources for Further Research

- Morningstar: Provides independent research and ratings on mutual funds and ETFs.

- Bloomberg: Offers financial news, data, and analytics.

- SEC’s Investor.gov: Provides educational resources on investing.

- Financial Advisors: Consult with a qualified financial advisor for personalized advice.

- Fund and ETF Prospectuses: Review the fund’s or ETF’s prospectus for detailed information.

Conclusion

Choosing between a mutual fund vs ETF depends on your individual investment goals, risk tolerance, and preferences. Mutual funds offer professional management and diversification, while ETFs provide flexibility and lower costs. By understanding the mutual fund vs ETF pros and cons explained in this guide, you can make informed decisions to build a well-rounded investment portfolio. Remember to consider your specific needs and consult with a financial professional if needed.

What are your experiences with mutual funds and ETFs? Share your thoughts in the comments below!

FAQ Section

Q1: Are ETFs always cheaper than mutual funds?

While ETFs generally have lower expense ratios, brokerage commissions can add up, especially if you trade frequently. Consider your trading frequency and compare the total costs before making a decision.

Q2: Are mutual funds actively managed, and ETFs passively managed?

Most ETFs are passively managed, tracking an index. However, there are also actively managed ETFs available. Mutual funds offer both actively and passively managed options.

Q3: Which is better for long-term investing: mutual funds or ETFs?

Both can be suitable for long-term investing. ETFs often have a slight edge due to their lower costs and tax efficiency. However, actively managed mutual funds may outperform over the long term if the fund manager is skilled.