Ever wondered what the real difference is between life insurance and health insurance? It’s easy to get them mixed up, but understanding the nuances can save you a lot of headaches and ensure you’re adequately protected. This article, Life insurance vs health insurance explained, will break down the key differences, benefits, and scenarios where each type of insurance shines.

Life Insurance vs Health Insurance Explained: A Quick Overview

At their core, life insurance vs health insurance serves different purposes. Life insurance provides a financial safety net for your loved ones in the event of your death. Health insurance, on the other hand, helps cover your medical expenses when you’re alive and need healthcare. Understanding this fundamental difference is the first step in making informed decisions about your insurance needs.

Understanding Life Insurance

Life insurance is a contract between you and an insurance company. In exchange for premium payments, the insurance company promises to pay a lump sum (the death benefit) to your beneficiaries upon your death.

Types of Life Insurance

There are primarily two main types of life insurance: term life and permanent life.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years.

If you die within the term, your beneficiaries receive the death benefit.

If the term expires and you’re still alive, the coverage ends, unless you renew the policy.

It’s generally more affordable than permanent life insurance, making it a popular choice for those on a budget.

Permanent Life Insurance

Permanent life insurance provides lifelong coverage.

It also includes a cash value component that grows over time on a tax-deferred basis.

You can borrow against the cash value or even withdraw from it, though this will reduce the death benefit.

Examples of permanent life insurance include whole life, universal life, and variable life.

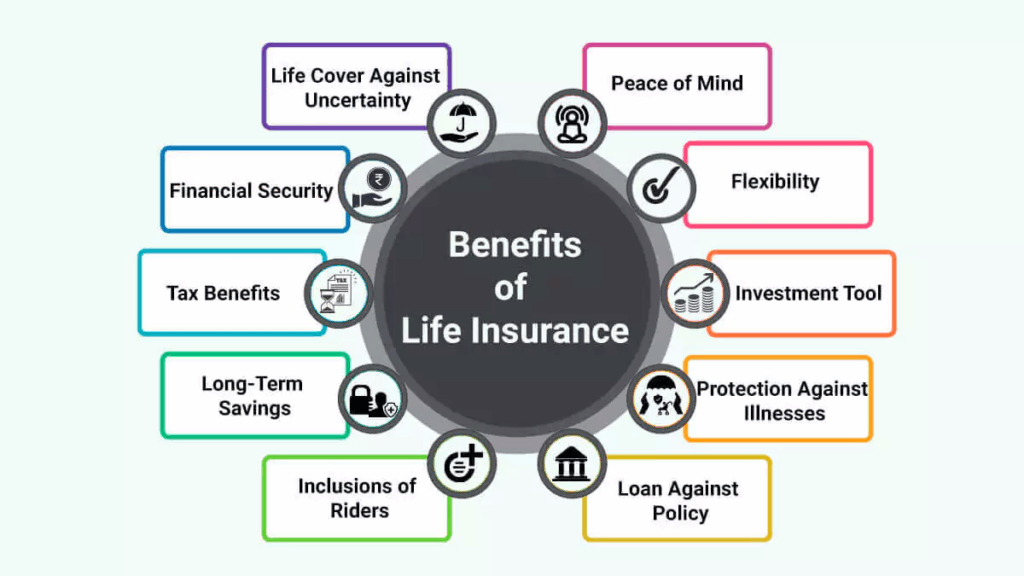

Benefits of Life Insurance

Life insurance offers numerous benefits, primarily centered around financial security for your loved ones.

Financial Security for Beneficiaries

The death benefit can help cover funeral expenses, outstanding debts, and living expenses for your family.

It can also provide funds for education, mortgage payments, and other long-term needs.

Estate Planning

Life insurance can be a valuable tool in estate planning.

It can help pay estate taxes and ensure a smooth transfer of assets to your heirs.

Peace of Mind

Knowing that your loved ones will be financially secure in the event of your death can provide significant peace of mind.

It allows you to focus on living your life to the fullest, knowing that you’ve taken steps to protect your family’s future.

When is Life Insurance Necessary?

Life insurance is particularly important if you have dependents who rely on your income.

This includes spouses, children, and even elderly parents.

It’s also beneficial if you have significant debts, such as a mortgage or student loans.

Business owners may also need life insurance to protect their business and ensure its continuity.

Understanding Health Insurance

Health insurance helps cover the cost of medical care, including doctor visits, hospital stays, and prescription drugs. It’s designed to protect you from the high costs of healthcare and ensure you have access to necessary medical services.

Types of Health Insurance

There are various types of health insurance plans, each with its own set of benefits and limitations.

Health Maintenance Organization (HMO)

HMO plans typically require you to choose a primary care physician (PCP) who coordinates your care.

You usually need a referral from your PCP to see a specialist.

HMOs often have lower premiums and out-of-pocket costs, but they may have more restrictions on which providers you can see.

Preferred Provider Organization (PPO)

PPO plans allow you to see any doctor or specialist without a referral.

However, you’ll typically pay less if you see providers within the plan’s network.

PPOs offer more flexibility than HMOs, but they often have higher premiums and out-of-pocket costs.

Exclusive Provider Organization (EPO)

EPO plans are similar to HMOs in that you typically need to stay within the plan’s network to receive coverage.

However, EPOs don’t usually require you to choose a PCP or get referrals to see specialists.

Point of Service (POS)

POS plans combine features of both HMOs and PPOs.

You typically choose a PCP who coordinates your care, but you can also see out-of-network providers for a higher cost.

Benefits of Health Insurance

Health insurance offers a wide range of benefits, primarily focused on accessing and affording healthcare services.

Access to Medical Care

Health insurance ensures you have access to necessary medical care, including preventive services, doctor visits, and hospital stays.

It helps you stay healthy and manage chronic conditions.

Financial Protection

Health insurance protects you from the high costs of medical care.

Without insurance, a serious illness or injury could lead to significant debt.

Preventive Services

Many health insurance plans cover preventive services, such as vaccinations, screenings, and checkups.

These services can help detect health problems early, when they’re easier to treat.

Prescription Drug Coverage

Health insurance often includes coverage for prescription drugs.

This can help you afford the medications you need to manage your health.

When is Health Insurance Necessary?

Health insurance is essential for everyone. Medical emergencies can happen at any time, and the cost of care can be substantial.

It’s especially important if you have a chronic condition or a family history of health problems.

Even if you’re young and healthy, health insurance can provide peace of mind and protect you from unexpected medical expenses.

Life Insurance vs Health Insurance Explained: Key Differences

Now that we’ve explored each type of insurance individually, let’s compare them directly. Understanding the life insurance vs health insurance explained differences will help you determine which type of coverage is right for you.

Purpose

Life insurance provides financial protection for your beneficiaries in the event of your death.

Health insurance covers your medical expenses while you’re alive.

Beneficiary

The beneficiary of a life insurance policy is the person or entity you designate to receive the death benefit.

The beneficiary of health insurance is typically you, the policyholder, although it can also cover dependents.

Coverage Period

Life insurance can be term-based (covering a specific period) or permanent (covering your entire life).

Health insurance is typically renewed annually, although the coverage can be continuous as long as you pay the premiums.

Cost

The cost of life insurance depends on factors such as your age, health, and the amount of coverage you need.

The cost of health insurance depends on factors such as your age, location, and the type of plan you choose.

Cash Value

Permanent life insurance policies often have a cash value component that grows over time.

Health insurance does not have a cash value component.

Tax Implications

Life insurance death benefits are generally tax-free to the beneficiaries.

Health insurance premiums may be tax-deductible, depending on your circumstances.

Choosing the Right Insurance for You

Deciding between life insurance vs health insurance explained depends on your individual needs and circumstances. Consider the following factors when making your decision:

Your Financial Situation

Assess your current financial situation, including your income, debts, and assets.

Determine how much life insurance you need to provide for your dependents in the event of your death.

Evaluate your healthcare needs and choose a health insurance plan that provides adequate coverage at an affordable price.

Your Family Needs

Consider the needs of your family, including your spouse, children, and elderly parents.

If you have dependents who rely on your income, life insurance is essential.

If you have a family history of health problems, health insurance is particularly important.

Your Long-Term Goals

Think about your long-term financial goals, such as retirement planning and estate planning.

Life insurance can be a valuable tool in achieving these goals.

Consider how health insurance fits into your overall financial plan.

Consulting with a Professional

If you’re unsure which type of insurance is right for you, consult with a qualified insurance professional.

They can help you assess your needs and recommend the best coverage options.

Combining Life Insurance and Health Insurance

In many cases, it’s beneficial to have both life insurance and health insurance. They serve different purposes and provide complementary protection.

Life insurance protects your loved ones in the event of your death.

Health insurance protects you from the high costs of medical care while you’re alive.

Having both types of insurance can provide comprehensive financial security and peace of mind.

Real-Life Scenarios: Life Insurance vs Health Insurance Explained

To further illustrate the differences between life insurance vs health insurance explained, let’s look at some real-life scenarios.

Scenario 1: John’s Unexpected Passing

John, a 45-year-old father of two, unexpectedly passed away due to a sudden heart attack.

He had a term life insurance policy with a death benefit of $500,000.

His beneficiaries, his wife and children, received the death benefit, which helped cover funeral expenses, mortgage payments, and living expenses.

Without life insurance, his family would have faced significant financial hardship.

Scenario 2: Sarah’s Medical Emergency

Sarah, a 30-year-old woman, experienced a medical emergency that required a hospital stay and surgery.

She had a health insurance policy with a low deductible and copays.

Her health insurance covered the majority of her medical expenses, saving her from incurring significant debt.

Without health insurance, she would have been responsible for paying tens of thousands of dollars in medical bills.

Scenario 3: Tom’s Chronic Condition

Tom, a 60-year-old man, has a chronic condition that requires ongoing medical care and prescription drugs.

He has a health insurance policy that provides comprehensive coverage for his medical needs.

His health insurance helps him manage his condition and maintain his quality of life.

Without health insurance, he would struggle to afford the medical care he needs.

The Future of Insurance

The insurance industry is constantly evolving, with new products and services emerging to meet the changing needs of consumers.

Technological advancements are playing a significant role in shaping the future of insurance.

Insurtech companies are using data analytics and artificial intelligence to personalize insurance products and improve the customer experience.

As the healthcare landscape continues to evolve, health insurance will likely become even more important.

Similarly, as people live longer, life insurance will remain a critical tool for estate planning and financial security.

Conclusion

Understanding the difference between life insurance vs health insurance explained is crucial for making informed decisions about your financial and healthcare needs. Life insurance provides a safety net for your loved ones in the event of your death, while health insurance protects you from the high costs of medical care while you’re alive.

Both types of insurance play essential roles in providing financial security and peace of mind. Consider your individual circumstances, consult with a professional, and choose the coverage options that are right for you. What are your experiences with life and health insurance? Share your thoughts and questions in the comments below!