Ever wonder what separates the folks who seem to effortlessly build wealth from those who just… don’t? It often boils down to understanding the fundamental difference between saving and investing.

Saving and investing are both essential parts of a sound financial strategy, but they serve different purposes and come with varying levels of risk and reward. This guide will break down everything you need to know, making your financial journey a whole lot clearer. Ready to unlock the secrets to financial success? Let’s dive in!

Saving vs. Investing: What’s the Real Deal?

At their core, both saving and investing are about growing your money. However, the difference between saving and investing lies in how you achieve that growth.

Saving is generally about keeping your money safe and accessible. Think of it as your financial safety net. Investing, on the other hand, is about putting your money to work to generate potentially higher returns over time, accepting a degree of risk in the process.

Saving: Your Financial Foundation

Saving is the bedrock of any solid financial plan. It’s about setting aside money regularly for short-term goals and emergencies.

Why Saving is Important

Saving provides a cushion for unexpected expenses, like a sudden car repair or medical bill.

It also helps you achieve short-term goals, such as a down payment on a car, a vacation, or even just a new gadget.

Where to Save Your Money

- Savings Accounts: These offer a safe place to store your money with a modest interest rate.

- Money Market Accounts: Similar to savings accounts, but often with higher interest rates and potentially higher minimum balances.

- Certificates of Deposit (CDs): These offer fixed interest rates for a specific period, usually higher than savings accounts, but your money is locked in for that term.

Investing: Growing Your Wealth

Investing is about taking calculated risks to potentially grow your money faster than you could with traditional savings methods.

Why Investing is Important

Investing allows you to outpace inflation, meaning your money retains its purchasing power over time.

It’s also essential for achieving long-term financial goals like retirement, buying a home, or funding your children’s education.

Where to Invest Your Money

- Stocks: Represent ownership in a company and can offer high growth potential, but also come with higher risk.

- Bonds: Represent loans to a government or corporation and are generally considered less risky than stocks.

- Mutual Funds: Pools of money from multiple investors that are managed by a professional fund manager, offering diversification.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges, offering flexibility and diversification.

- Real Estate: Investing in properties can provide rental income and potential appreciation in value.

Key Differences: Saving vs. Investing

Let’s break down the difference between saving and investing with a clear comparison:

| Feature | Saving | Investing |

|---|---|---|

| Purpose | Short-term goals, emergency fund | Long-term goals, wealth building |

| Risk Level | Low | Moderate to High |

| Return Potential | Low | High |

| Liquidity | High (easily accessible) | Varies (can be less accessible) |

| Time Horizon | Short-term (less than 5 years) | Long-term (5 years or more) |

| Examples | Savings account, money market account, CD | Stocks, bonds, mutual funds, real estate |

Risk Tolerance: A Crucial Factor

Understanding your risk tolerance is key to deciding how to allocate your money between saving and investing.

Are you comfortable with the possibility of losing some of your money in exchange for potentially higher returns?

Or do you prefer the safety and security of knowing your principal is protected, even if the returns are lower?

Time Horizon: How Long Do You Have?

Your time horizon, or how long you have until you need the money, also plays a significant role.

For short-term goals, saving is generally the best option.

For long-term goals, investing can be a powerful tool to grow your wealth.

Building a Balanced Financial Strategy

The most effective financial strategy often involves a combination of both saving and investing.

The Emergency Fund: Your First Priority

Before you start investing, it’s crucial to have an emergency fund in place.

This fund should cover 3-6 months of living expenses and be easily accessible in a savings account or money market account.

Diversification: Spreading Your Risk

Diversification is a key principle in investing. It involves spreading your investments across different asset classes to reduce risk.

Don’t put all your eggs in one basket!

Rebalancing: Staying on Track

Over time, your investment portfolio may drift away from your target allocation.

Rebalancing involves selling some assets and buying others to bring your portfolio back into alignment with your desired risk level.

Common Investing Mistakes to Avoid

Even with the best intentions, it’s easy to make mistakes when investing. Here are a few common pitfalls to avoid:

Emotional Investing

Making investment decisions based on fear or greed can lead to poor results.

Stick to your long-term plan and avoid reacting to short-term market fluctuations.

Not Diversifying

Failing to diversify your investments can increase your risk.

Spread your money across different asset classes, industries, and geographic regions.

Trying to Time the Market

Trying to predict market peaks and valleys is a losing game.

Focus on long-term growth and invest consistently over time.

Ignoring Fees

Investment fees can eat into your returns over time.

Pay attention to the fees charged by your investment accounts and choose low-cost options whenever possible.

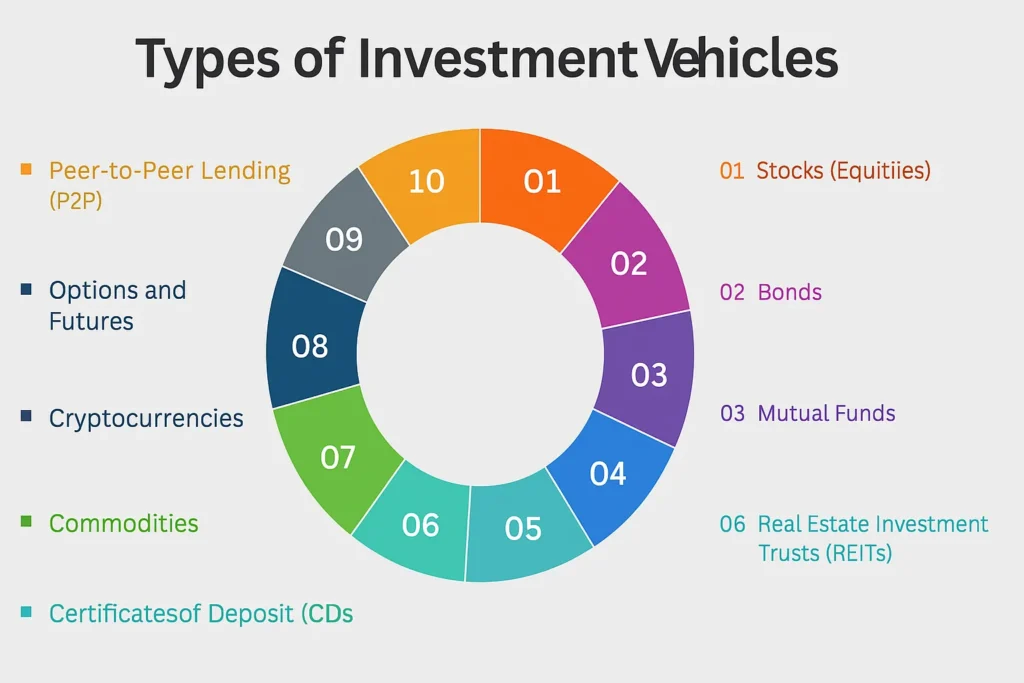

Understanding Investment Vehicles in Detail

Let’s explore some of the most common investment vehicles in more detail:

Stocks: Ownership in a Company

Stocks represent ownership in a company. When you buy stock, you become a shareholder and are entitled to a portion of the company’s profits.

Types of Stocks

- Common Stock: Gives you voting rights in the company and the potential to receive dividends.

- Preferred Stock: Does not typically give you voting rights, but offers a fixed dividend payment.

Factors Affecting Stock Prices

- Company Performance: The financial health and performance of the company.

- Economic Conditions: Overall economic growth or recession.

- Industry Trends: Trends and developments in the company’s industry.

- Investor Sentiment: The overall mood and expectations of investors.

Bonds: Lending to Governments and Corporations

Bonds represent loans that you make to a government or corporation. In return, you receive interest payments over a specified period.

Types of Bonds

- Government Bonds: Issued by national governments and are generally considered very safe.

- Corporate Bonds: Issued by corporations and offer higher yields than government bonds, but also come with higher risk.

- Municipal Bonds: Issued by state and local governments and are often tax-exempt.

Factors Affecting Bond Prices

- Interest Rates: Bond prices move inversely to interest rates.

- Credit Ratings: The creditworthiness of the issuer.

- Inflation: Inflation can erode the value of bond yields.

Mutual Funds: Diversification Made Easy

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

Types of Mutual Funds

- Stock Funds: Invest primarily in stocks.

- Bond Funds: Invest primarily in bonds.

- Balanced Funds: Invest in a mix of stocks and bonds.

- Index Funds: Track a specific market index, such as the S&P 500.

Advantages of Mutual Funds

- Diversification: Instant diversification across a wide range of assets.

- Professional Management: Managed by experienced fund managers.

- Accessibility: Relatively easy to buy and sell.

Exchange-Traded Funds (ETFs): The Best of Both Worlds

ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks.

Advantages of ETFs

- Flexibility: Can be bought and sold throughout the day.

- Low Costs: Generally lower expense ratios than mutual funds.

- Tax Efficiency: Often more tax-efficient than mutual funds.

Real Estate: Tangible Investments

Real estate involves investing in properties, such as residential homes, commercial buildings, or land.

Ways to Invest in Real Estate

- Direct Ownership: Buying properties directly and renting them out.

- Real Estate Investment Trusts (REITs): Investing in companies that own and operate real estate.

Advantages of Real Estate

- Potential Rental Income: Generating income from renting out properties.

- Appreciation Potential: The value of the property may increase over time.

- Tax Benefits: Various tax deductions and credits are available for real estate investors.

The Role of Inflation

Inflation plays a critical role in the difference between saving and investing.

Inflation erodes the purchasing power of your money over time.

Therefore, it’s essential to invest in assets that can outpace inflation to maintain your wealth.

How Inflation Affects Saving

Savings accounts typically offer low interest rates that may not keep pace with inflation.

This means that the real value of your savings can decline over time.

How Inflation Affects Investing

Investing in assets like stocks and real estate can provide higher returns that outpace inflation.

This helps to preserve and grow your wealth over the long term.

Seeking Professional Advice

If you’re unsure about how to allocate your money between saving and investing, consider seeking advice from a financial advisor.

A financial advisor can help you assess your risk tolerance, set financial goals, and create a personalized investment plan.

Benefits of Working with a Financial Advisor

- Expert Guidance: Receive expert advice on investment strategies and financial planning.

- Personalized Plan: Develop a personalized plan tailored to your specific needs and goals.

- Objective Advice: Get objective advice without emotional biases.

Conclusion

Understanding the difference between saving and investing is essential for building a secure financial future. Saving provides a safety net and helps you achieve short-term goals, while investing allows you to grow your wealth over the long term. By creating a balanced financial strategy that incorporates both saving and investing, you can work towards achieving your financial dreams.

What are your preferred saving and investing strategies? Share your thoughts and experiences in the comments below!

FAQ Section

Here are some frequently asked questions about the difference between saving and investing:

Q: Is it better to save or invest?

A: It depends on your financial goals and time horizon. Saving is best for short-term goals and emergencies, while investing is better for long-term goals like retirement.

Q: How much should I save before I start investing?

A: Aim to have 3-6 months of living expenses in an emergency fund before you start investing.

Q: What is the safest way to invest my money?

A: Bonds are generally considered less risky than stocks, but they also offer lower returns. Diversifying your investments across different asset classes can also help to reduce risk.