Ever feel like the economy is a rollercoaster? One minute you’re soaring high, the next you’re plummeting down. Understanding these ups and downs is crucial, especially for business owners and investors.

In this article, we’ll break down business cycle phases and what they mean for you. We’ll explore each stage, from boom to bust, and how to navigate them effectively. Let’s demystify the economic ride.

Understanding the Business Cycle

The business cycle, also known as the economic cycle, refers to the fluctuations in economic activity that an economy experiences over a period of time. It’s a recurring but not periodic pattern of expansion and contraction.

These fluctuations are typically measured by indicators like GDP, employment rates, and industrial production. Comprehending the business cycle is vital for strategic decision-making.

What Causes the Business Cycle?

Several factors contribute to the business cycle’s ebbs and flows. These include:

- Changes in consumer confidence: Optimism leads to increased spending, while pessimism leads to decreased spending.

- Interest rate fluctuations: Lower rates encourage borrowing and investment, while higher rates discourage them.

- Government policies: Fiscal and monetary policies can stimulate or restrain economic activity.

- External shocks: Unexpected events like pandemics, natural disasters, or geopolitical crises can significantly impact the economy.

- Technological advancements: Innovations can drive economic growth but also lead to disruptions and adjustments.

Key Indicators to Watch

Monitoring key economic indicators can help anticipate shifts in the business cycle. Some of the most important indicators include:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed.

- Inflation Rate: Measures the rate at which prices are rising.

- Consumer Confidence Index: Reflects consumer sentiment about the economy.

- Interest Rates: Influenced by central banks and affect borrowing costs.

- Stock Market Performance: Can be a leading indicator of economic activity.

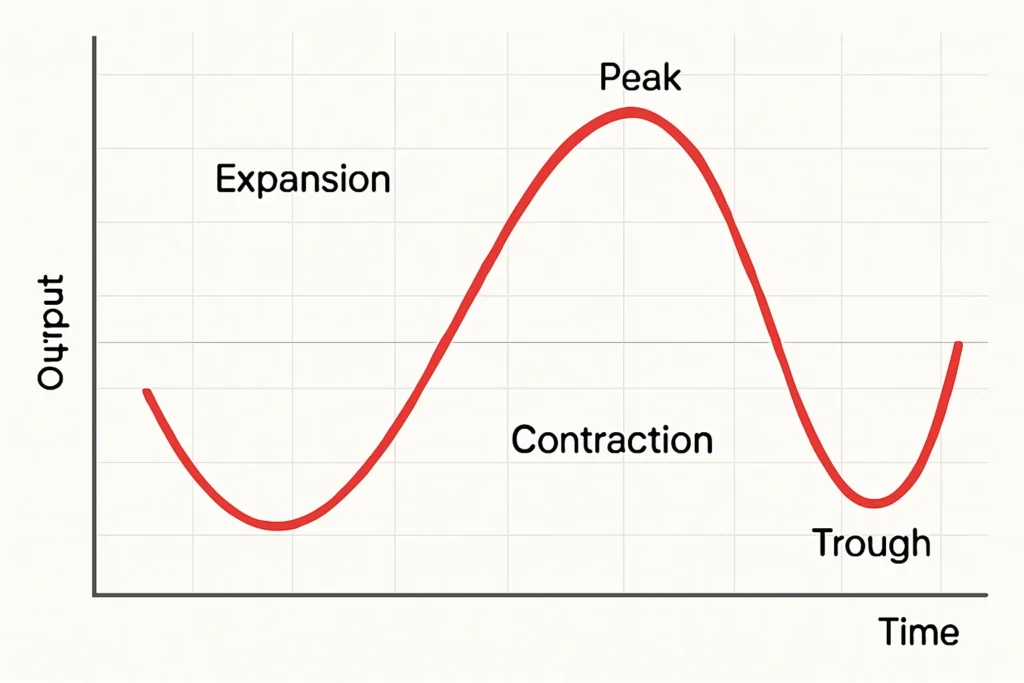

The Four Phases of the Business Cycle

The business cycle typically consists of four distinct phases: expansion, peak, contraction, and trough. Each phase has unique characteristics and implications.

1. Expansion (Recovery)

The expansion phase is characterized by economic growth. During this phase, businesses thrive, employment increases, and consumer spending rises.

It’s a period of optimism and investment.

Characteristics of the Expansion Phase

- Increased GDP: The economy experiences sustained growth in the production of goods and services.

- Rising Employment: Businesses hire more workers, reducing the unemployment rate.

- Increased Consumer Spending: Consumers are more confident and willing to spend money.

- Rising Inflation: As demand increases, prices may start to rise.

- Increased Investment: Businesses invest in new equipment and expansion projects.

Strategies for Businesses During Expansion

- Invest in Growth: Expand operations, hire new employees, and invest in new technologies.

- Increase Production: Meet the growing demand for products and services.

- Manage Inventory: Ensure sufficient inventory to meet demand without overstocking.

- Monitor Costs: Keep an eye on rising costs due to inflation.

- Strengthen Customer Relationships: Focus on customer retention and loyalty.

2. Peak

The peak represents the highest point of economic activity in the business cycle. It’s a turning point where the economy reaches its maximum potential.

After the peak, the economy begins to slow down.

Characteristics of the Peak Phase

- High GDP: The economy reaches its maximum output.

- Low Unemployment: The unemployment rate is at its lowest point.

- High Inflation: Prices are rising rapidly due to high demand.

- Capacity Constraints: Businesses may struggle to meet demand due to limited resources.

- Increased Interest Rates: Central banks may raise interest rates to combat inflation.

Strategies for Businesses During the Peak

- Focus on Efficiency: Streamline operations and improve productivity.

- Manage Costs: Control expenses to maintain profitability.

- Build Cash Reserves: Prepare for a potential economic downturn.

- Review Investment Plans: Reassess investment plans and prioritize essential projects.

- Strengthen Balance Sheet: Reduce debt and improve financial stability.

3. Contraction (Recession)

The contraction phase, also known as a recession, is characterized by economic decline. During this phase, businesses struggle, employment decreases, and consumer spending falls.

It’s a period of uncertainty and retrenchment.

Characteristics of the Contraction Phase

- Decreased GDP: The economy experiences a decline in the production of goods and services.

- Rising Unemployment: Businesses lay off workers, increasing the unemployment rate.

- Decreased Consumer Spending: Consumers reduce spending due to economic uncertainty.

- Falling Inflation (or Deflation): Prices may stabilize or even fall due to decreased demand.

- Decreased Investment: Businesses cut back on investment and expansion plans.

Strategies for Businesses During Contraction

- Reduce Costs: Cut expenses and streamline operations.

- Manage Cash Flow: Focus on maintaining positive cash flow.

- Retain Key Employees: Protect your most valuable assets.

- Adjust Inventory: Reduce inventory levels to avoid overstocking.

- Focus on Customer Retention: Maintain relationships with existing customers.

- Explore New Markets: Look for opportunities in less affected sectors.

4. Trough

The trough represents the lowest point of economic activity in the business cycle. It’s a turning point where the economy bottoms out.

After the trough, the economy begins to recover.

Characteristics of the Trough Phase

- Low GDP: The economy reaches its minimum output.

- High Unemployment: The unemployment rate is at its highest point.

- Low Inflation (or Deflation): Prices are stable or falling.

- Low Interest Rates: Central banks may lower interest rates to stimulate the economy.

- Decreased Investment: Businesses are hesitant to invest due to economic uncertainty.

Strategies for Businesses During the Trough

- Prepare for Recovery: Position your business for future growth.

- Invest in Innovation: Develop new products and services.

- Improve Efficiency: Streamline operations and reduce costs.

- Build Relationships: Strengthen relationships with customers and suppliers.

- Monitor Economic Indicators: Keep an eye on signs of economic recovery.

- Seek Opportunities: Look for undervalued assets and potential acquisitions.

Examples of Business Cycle Phases

Understanding the phases of the business cycle can be better grasped through real-world examples. Here are a few notable instances:

The Dot-Com Boom and Bust (Late 1990s – Early 2000s)

- Expansion: The late 1990s saw a rapid expansion fueled by the growth of the internet and technology companies.

- Peak: The peak occurred around 2000, with high stock valuations and widespread optimism.

- Contraction: The dot-com bubble burst, leading to a significant stock market decline and economic slowdown.

- Trough: The trough was reached in 2002, followed by a gradual recovery.

The 2008 Financial Crisis

- Expansion: The early 2000s saw an expansion driven by the housing market and financial innovation.

- Peak: The peak occurred in 2007, with high housing prices and excessive risk-taking.

- Contraction: The financial crisis of 2008 led to a severe recession, with widespread job losses and economic disruption.

- Trough: The trough was reached in 2009, followed by a slow and uneven recovery.

The COVID-19 Pandemic (2020 – Present)

- Expansion: The period leading up to 2020 was characterized by steady economic growth.

- Peak: The peak occurred in early 2020, just before the pandemic hit.

- Contraction: The pandemic caused a sharp contraction in economic activity, with widespread lockdowns and business closures.

- Trough: The trough was reached in mid-2020, followed by a recovery driven by government stimulus and vaccine rollout.

How to Predict the Business Cycle

Predicting the business cycle is challenging, but not impossible. Economists and analysts use various tools and techniques to forecast economic trends.

Economic Indicators

As mentioned earlier, monitoring key economic indicators can provide valuable insights into the current state of the economy and potential future trends.

Leading indicators, such as the stock market and consumer confidence, tend to change before the overall economy. Lagging indicators, such as unemployment and inflation, tend to change after the overall economy.

Economic Models

Economists use various models to forecast economic activity. These models incorporate factors such as GDP, employment, inflation, and interest rates.

Some popular models include:

- Econometric Models: Use statistical techniques to analyze historical data and predict future trends.

- Agent-Based Models: Simulate the behavior of individual economic agents to understand aggregate outcomes.

- Dynamic Stochastic General Equilibrium (DSGE) Models: Incorporate microeconomic principles to model macroeconomic phenomena.

Expert Opinions

Following the opinions of economists and market analysts can provide valuable perspectives on the business cycle. These experts often have access to proprietary data and insights.

However, it’s important to remember that no forecast is perfect, and experts can disagree on the outlook for the economy.

Strategies for Investors

Understanding the business cycle is crucial for making informed investment decisions. Different asset classes perform differently in each phase of the cycle.

Expansion Phase

During the expansion phase, stocks tend to perform well as corporate earnings increase. Real estate can also be a good investment as demand for housing rises.

Peak Phase

During the peak phase, it may be wise to reduce exposure to risky assets like stocks and increase holdings of more conservative assets like bonds.

Contraction Phase

During the contraction phase, bonds tend to outperform stocks as investors seek safety. Defensive stocks, such as those in the healthcare and consumer staples sectors, may also hold up relatively well.

Trough Phase

During the trough phase, it may be a good time to start buying stocks as the economy begins to recover. Value stocks, which are undervalued relative to their fundamentals, may offer attractive opportunities.

The Role of Government

Governments play a significant role in managing the business cycle through fiscal and monetary policies.

Fiscal Policy

Fiscal policy involves the use of government spending and taxation to influence economic activity. During a recession, governments may increase spending or cut taxes to stimulate demand. During an expansion, they may decrease spending or raise taxes to cool down the economy.

Monetary Policy

Monetary policy involves the use of interest rates and other tools to control the money supply and credit conditions. Central banks may lower interest rates to stimulate borrowing and investment during a recession. They may raise interest rates to combat inflation during an expansion.

Regulations

Government regulations can also impact the business cycle. Regulations can promote stability and prevent excessive risk-taking, but they can also stifle innovation and economic growth.

The Future of the Business Cycle

The business cycle is constantly evolving due to technological advancements, globalization, and other factors. Some economists believe that the business cycle is becoming less pronounced due to improved monetary policy and other factors.

Others argue that new technologies and global interconnectedness are creating new sources of volatility. Understanding these trends is crucial for navigating the economic landscape.

In conclusion, understanding business cycle phases and what they mean is essential for businesses, investors, and policymakers alike. By monitoring key economic indicators, analyzing economic models, and following expert opinions, you can better anticipate shifts in the business cycle and make informed decisions. What strategies have you found most effective during different phases of the economic cycle? Share your experiences!