Ever feel like your money is disappearing faster than free pizza at an office party? You’re not alone. Many people struggle to keep track of their finances, especially when they’re just starting out. But fear not! This article is packed with budgeting tips for beginners that will help you take control of your finances and achieve your financial goals.

Understanding the Basics of Budgeting

Budgeting isn’t about deprivation; it’s about making informed choices about where your money goes. It’s about prioritizing what’s important to you and ensuring you have enough to cover your needs and wants. Let’s break down the essential elements.

What is a Budget?

A budget is simply a plan for how you’ll spend your money. It outlines your income and expenses, allowing you to see where your money is going each month.

Think of it as a roadmap to financial freedom. It helps you stay on track and avoid overspending.

Why is Budgeting Important?

Budgeting offers several benefits, including:

- Financial Awareness: Knowing exactly where your money goes.

- Debt Management: Identifying areas where you can cut back and pay off debt.

- Savings Goals: Setting aside money for future goals, like a down payment on a house or retirement.

- Reduced Stress: Eliminating the anxiety of not knowing where your money is going.

It’s empowering to take control of your financial life. Budgeting is the first step.

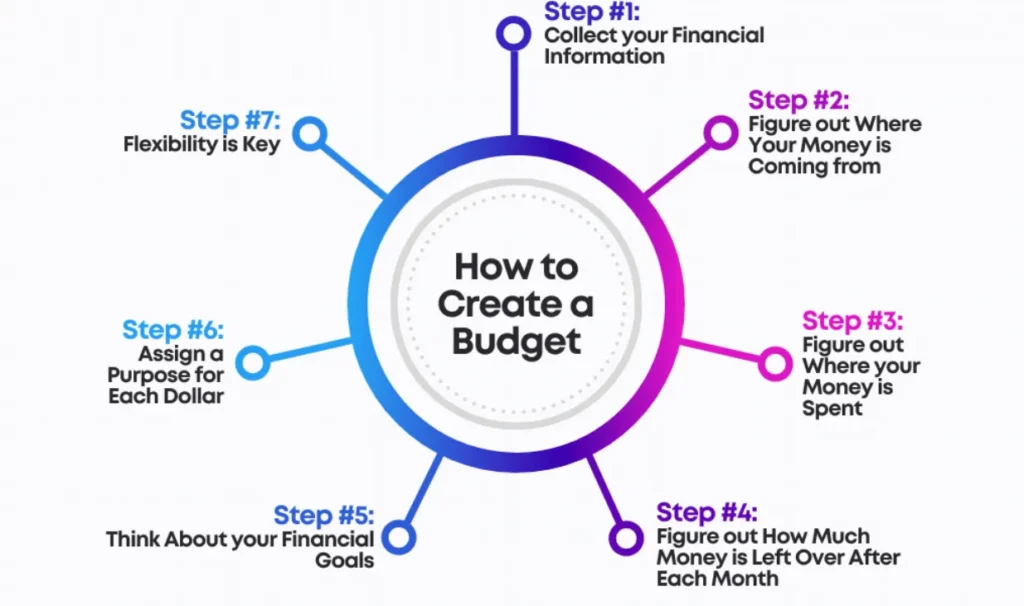

Step-by-Step Guide to Creating Your First Budget

Creating a budget might seem daunting, but it’s actually quite simple. Follow these steps to get started.

Step 1: Calculate Your Income

Start by determining your monthly income. This includes your salary, wages, or any other sources of revenue.

If your income fluctuates, calculate an average based on the past few months. Be realistic and conservative.

Step 2: Track Your Expenses

Next, track your expenses for a month. You can use a notebook, spreadsheet, or budgeting app.

Categorize your expenses into fixed (rent, utilities) and variable (groceries, entertainment). This will help you see where your money is going.

Step 3: Categorize Your Expenses

Organizing your expenses is key to understanding your spending habits. Common categories include:

- Housing: Rent, mortgage, property taxes, insurance.

- Transportation: Car payments, gas, public transportation.

- Food: Groceries, eating out.

- Utilities: Electricity, water, gas, internet, phone.

- Healthcare: Insurance premiums, medical bills.

- Debt Payments: Credit cards, loans.

- Entertainment: Movies, concerts, hobbies.

- Personal Care: Haircuts, toiletries.

Step 4: Create Your Budget

Now, it’s time to create your budget. Compare your income to your expenses.

If your expenses exceed your income, you’ll need to make some adjustments. Look for areas where you can cut back.

Step 5: Implement and Monitor Your Budget

Once you’ve created your budget, stick to it! Monitor your spending regularly.

Use your chosen method (notebook, spreadsheet, app) to track your progress. Make adjustments as needed.

Effective Budgeting Methods for Beginners

There are several budgeting methods you can choose from. Here are a few popular options:

The 50/30/20 Rule

This simple method allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

It’s a great starting point for budgeting tips for beginners because it’s easy to understand and implement. Adjust the percentages as needed to fit your specific circumstances.

Zero-Based Budgeting

With zero-based budgeting, you allocate every dollar of your income to a specific category. The goal is to have your income minus your expenses equal zero.

This method requires more planning but provides a clear picture of where your money is going. It helps you be intentional with your spending.

Envelope Budgeting

This method involves using physical envelopes to allocate cash for different spending categories. For example, you might have an envelope for groceries, entertainment, and gas.

Once the money in an envelope is gone, you can’t spend any more in that category until the next month. It’s a great way to control spending and avoid overspending.

Budgeting Apps

Numerous budgeting apps can help you track your income and expenses, set goals, and stay on track. Popular options include Mint, YNAB (You Need a Budget), and Personal Capital.

These apps often sync with your bank accounts and credit cards, making it easy to monitor your spending. They can also provide insights into your spending habits.

Practical Tips for Sticking to Your Budget

Creating a budget is one thing; sticking to it is another. Here are some practical budgeting tips for beginners to help you stay on track:

Set Realistic Goals

Don’t try to cut back too much too quickly. Start with small, achievable goals.

For example, instead of trying to save 50% of your income, start with 10% and gradually increase it over time.

Automate Your Savings

Set up automatic transfers from your checking account to your savings account each month. This makes saving effortless.

Consider setting up multiple savings accounts for different goals, such as a vacation fund and an emergency fund.

Track Your Spending Regularly

Monitor your spending at least once a week to stay aware of your progress. Review your budget and make adjustments as needed.

Use your chosen method (notebook, spreadsheet, app) to track your spending and identify areas where you can cut back.

Avoid Impulse Purchases

Before making a purchase, ask yourself if you really need it. Wait 24 hours before buying something you’re not sure about.

Unnecessary purchases can quickly derail your budget. Be mindful of your spending habits.

Find Free or Low-Cost Entertainment

Look for free or low-cost activities to enjoy, such as hiking, visiting a museum on a free day, or having a potluck with friends.

Entertainment doesn’t have to be expensive. Get creative and find ways to have fun without breaking the bank.

Cook at Home More Often

Eating out can be expensive. Cooking at home is a great way to save money on food.

Plan your meals in advance and make a grocery list to avoid impulse purchases.

Review Your Budget Regularly

Your budget is not set in stone. Review it regularly and make adjustments as needed.

Life changes, such as a new job or a change in expenses, may require you to update your budget.

Saving Money on Common Expenses

Here are some specific budgeting tips for beginners on how to save money on common expenses:

Housing

- Consider downsizing: If you have more space than you need, consider moving to a smaller, more affordable home.

- Refinance your mortgage: If interest rates have dropped, consider refinancing your mortgage to lower your monthly payments.

- Rent out a spare room: If you have a spare room, consider renting it out to a roommate to help offset your housing costs.

Transportation

- Carpool: Share rides with coworkers or friends to save on gas and parking.

- Use public transportation: If possible, use public transportation instead of driving.

- Maintain your car: Regular maintenance can prevent costly repairs down the road.

Food

- Plan your meals: Planning your meals in advance can help you avoid impulse purchases and reduce food waste.

- Shop with a list: Stick to your grocery list to avoid buying things you don’t need.

- Cook in bulk: Cooking in bulk can save you time and money.

Utilities

- Conserve energy: Turn off lights when you leave a room, unplug electronics when they’re not in use, and use energy-efficient appliances.

- Adjust your thermostat: Lower your thermostat in the winter and raise it in the summer to save on heating and cooling costs.

- Use less water: Take shorter showers, fix leaky faucets, and water your lawn less often.

Debt

- Pay off high-interest debt first: Focus on paying off your credit cards and other high-interest debt as quickly as possible.

- Consolidate your debt: Consider consolidating your debt into a lower-interest loan.

- Negotiate with creditors: Contact your creditors and ask if they’re willing to lower your interest rates or offer a payment plan.

Dealing with Unexpected Expenses

Life is full of surprises, and sometimes those surprises come with a price tag. Here’s how to handle unexpected expenses without derailing your budget:

Build an Emergency Fund

An emergency fund is a savings account specifically for unexpected expenses. Aim to save at least 3-6 months’ worth of living expenses.

This will provide a financial cushion to fall back on when unexpected expenses arise. Start small and gradually build up your emergency fund over time.

Adjust Your Budget

When an unexpected expense arises, adjust your budget to accommodate it. Look for areas where you can cut back temporarily.

For example, you might reduce your entertainment budget or postpone a non-essential purchase.

Use a Credit Card Wisely

If you don’t have enough cash to cover an unexpected expense, you can use a credit card. However, be sure to pay off the balance as quickly as possible to avoid interest charges.

Consider using a credit card with a 0% introductory APR to give yourself more time to pay off the balance.

Don’t Panic

It’s easy to panic when faced with an unexpected expense. However, try to stay calm and assess the situation.

Develop a plan for how you’ll cover the expense and get back on track with your budget.

Long-Term Financial Planning

Budgeting is just one piece of the financial puzzle. It’s also important to plan for the long term.

Set Financial Goals

What do you want to achieve financially? Do you want to buy a house, retire early, or travel the world?

Setting financial goals will help you stay motivated and focused on your budget. Make your goals specific, measurable, achievable, relevant, and time-bound (SMART).

Invest for the Future

Investing is a great way to grow your wealth over time. Consider investing in stocks, bonds, or mutual funds.

Start small and gradually increase your investments as you become more comfortable. Consult with a financial advisor to determine the best investment strategy for your needs.

Plan for Retirement

Retirement may seem far away, but it’s important to start planning now. Contribute to a retirement account, such as a 401(k) or IRA.

Take advantage of employer matching contributions to maximize your savings. Consider consulting with a financial advisor to create a retirement plan.

Protect Your Assets

Protect your assets with insurance. This includes health insurance, homeowners insurance, and auto insurance.

Review your insurance policies regularly to ensure you have adequate coverage. Consider purchasing life insurance to protect your loved ones in the event of your death.

Conclusion

Mastering budgeting tips for beginners is a journey, not a destination. It requires consistent effort, self-awareness, and a willingness to adapt. By understanding the basics, choosing a suitable method, and implementing practical tips, you can gain control of your finances and achieve your financial goals. Don’t be afraid to experiment and find what works best for you. Share your budgeting experiences and tips in the comments below!