Ever feel like you’re missing out on the investing game? You see others building wealth, but the stock market feels like a complicated maze. Don’t worry, you’re not alone. The good news is that with the right tools, anyone can start investing. We’re diving into the best investing apps for beginners in 2025, making your journey to financial freedom easier than ever.

Why You Need an Investing App

Investing used to be a complex process involving brokers and hefty fees. Now, it’s as simple as downloading an app.

Investing apps offer a user-friendly platform to buy and sell stocks, bonds, and other assets. They provide real-time data, educational resources, and often, commission-free trading. This makes investing accessible and affordable, especially for beginners.

Key Features to Look for in Investing Apps

Not all investing apps are created equal. Knowing what to look for can save you time and money.

User-Friendly Interface

The app should be easy to navigate. Clear instructions and intuitive design are essential.

Look for apps with a clean layout and simple menus. You shouldn’t need a finance degree to understand how to buy a stock.

Commission-Free Trading

High fees can eat into your profits. Commission-free trading allows you to invest without paying a fee for each trade.

This is especially beneficial for beginners who might be making smaller, more frequent trades. Every dollar saved is a dollar that can be invested.

Educational Resources

Learning the basics is crucial. The best apps offer educational articles, tutorials, and webinars.

These resources can help you understand investment strategies, risk management, and market trends. Knowledge is power when it comes to investing.

Account Minimums

Some apps require a minimum deposit to open an account. Others allow you to start with as little as $1.

For beginners, starting small can be less intimidating. Look for apps with low or no account minimums.

Investment Options

Consider the types of investments you’re interested in. Some apps offer stocks, bonds, ETFs, and mutual funds. Others might include cryptocurrency or real estate.

Choose an app that aligns with your investment goals. Diversification is key to managing risk.

Security

Your financial information should be protected. Look for apps with strong security measures, such as two-factor authentication and encryption.

Check if the app is regulated by financial authorities like the SEC or FINRA. Your peace of mind is priceless.

Top Investing Apps for Beginners in 2025

Here are some of the top contenders for the best investing apps for beginners in 2025, each offering unique features and benefits.

Robinhood

Robinhood revolutionized the industry with its commission-free trading. It’s a popular choice for beginners.

Pros:

- Commission-free trading.

- User-friendly interface.

- Fractional shares available.

Cons:

- Limited educational resources.

- Can encourage impulsive trading.

- Customer service can be slow.

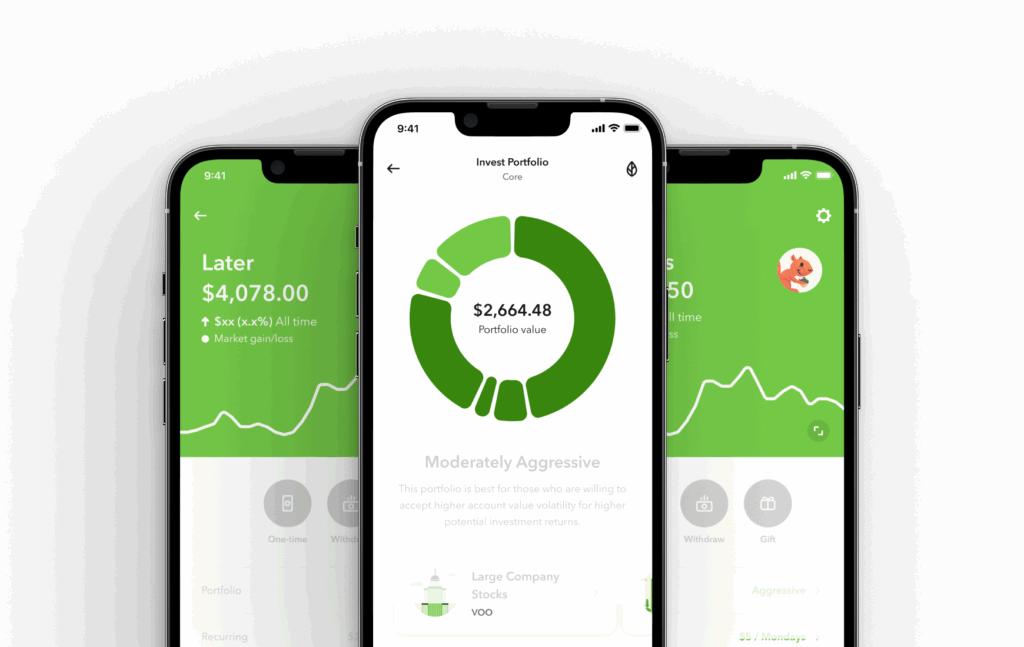

Acorns

Acorns focuses on micro-investing. It rounds up your purchases and invests the spare change.

Pros:

- Automatic investing.

- Simple and easy to use.

- Educational content tailored for beginners.

Cons:

- Monthly fees can add up for small accounts.

- Limited investment options.

- Not ideal for active traders.

Fidelity

Fidelity offers a comprehensive platform with a wide range of investment options. It’s a great choice for beginners who want to grow their knowledge.

Pros:

- Extensive research and educational resources.

- No account minimums.

- Excellent customer service.

Cons:

- Interface can be overwhelming for some beginners.

- More complex than other apps.

- Requires more active management.

Charles Schwab

Charles Schwab is a well-established brokerage firm. It offers a robust platform with a variety of investment tools.

Pros:

- Wide range of investment options.

- Excellent research and analysis tools.

- Strong customer support.

Cons:

- Can be overwhelming for absolute beginners.

- More suited for intermediate investors.

- Requires more active management.

Webull

Webull is similar to Robinhood, offering commission-free trading and a user-friendly interface. It also includes more advanced features for experienced traders.

Pros:

- Commission-free trading.

- Real-time market data.

- Paper trading for practice.

Cons:

- Limited investment options compared to traditional brokerages.

- Can be confusing for complete beginners.

- Customer service can be slow.

Public.com

Public.com combines investing with social networking. It allows you to follow other investors and share your strategies.

Pros:

- Social investing features.

- Fractional shares available.

- Educational resources.

Cons:

- Focus on social interaction can distract from investing goals.

- Limited investment options.

- Not ideal for privacy-focused investors.

SoFi

SoFi offers a range of financial products, including investing, loans, and banking. It’s a convenient option for managing all your finances in one place.

Pros:

- Integrated financial services.

- Automated investing options.

- Educational resources.

Cons:

- Fees can be higher than other apps.

- Limited investment options.

- May not be the best choice for active traders.

How to Choose the Right Investing App for You

Choosing the best investing app for beginners in 2025 depends on your individual needs and preferences. Consider these factors:

Your Investment Goals

What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or another long-term goal?

Your goals will influence the types of investments you choose and the features you need in an app.

Your Risk Tolerance

How comfortable are you with the possibility of losing money? Are you a conservative investor or are you willing to take more risks for potentially higher returns?

Understanding your risk tolerance will help you choose appropriate investments and an app that aligns with your comfort level.

Your Level of Knowledge

How much do you already know about investing? Are you a complete beginner or do you have some experience with the stock market?

Choose an app that provides the right level of education and support for your current knowledge.

Your Budget

How much money are you willing to invest? Some apps require a minimum deposit, while others allow you to start with as little as $1.

Consider your budget and choose an app that fits your financial situation.

Your Preferred Trading Style

Do you plan to actively trade stocks or do you prefer a more passive, hands-off approach?

Choose an app that supports your preferred trading style and offers the tools and features you need.

Tips for Beginner Investors

Starting your investment journey can be exciting, but it’s important to approach it with caution and a plan.

Start Small

You don’t need a lot of money to start investing. Begin with a small amount that you’re comfortable losing.

As you gain experience and confidence, you can gradually increase your investment amount.

Diversify Your Investments

Don’t put all your eggs in one basket. Spread your investments across different asset classes, industries, and geographic regions.

Diversification can help reduce your risk and improve your long-term returns.

Do Your Research

Before investing in any stock or asset, take the time to research the company, industry, and market trends.

Understand the risks and potential rewards before making any investment decisions.

Be Patient

Investing is a long-term game. Don’t expect to get rich overnight.

Be patient and stay focused on your long-term goals. Don’t panic sell during market downturns.

Reinvest Dividends

If your investments pay dividends, consider reinvesting them to buy more shares.

Reinvesting dividends can help accelerate your returns over time.

Stay Informed

Keep up with market news and trends. Read financial publications, follow reputable financial experts, and stay informed about the companies you invest in.

The more you know, the better equipped you’ll be to make informed investment decisions.

Don’t Follow the Crowd

Just because everyone else is investing in a particular stock or asset doesn’t mean you should too.

Do your own research and make your own investment decisions based on your own goals and risk tolerance.

Avoid Emotional Investing

Don’t let your emotions cloud your judgment. Avoid making impulsive investment decisions based on fear or greed.

Stick to your investment plan and stay disciplined.

Seek Professional Advice

If you’re unsure about anything, don’t hesitate to seek professional advice from a financial advisor.

A financial advisor can help you create a personalized investment plan and provide guidance on how to achieve your financial goals.

The Future of Investing Apps

The landscape of investing apps is constantly evolving. Expect to see even more innovation and features in the coming years.

Artificial Intelligence (AI)

AI is already playing a role in investing apps, and its influence will only grow. AI-powered tools can provide personalized investment recommendations, automate portfolio management, and detect fraudulent activity.

Gamification

Some apps are incorporating gamification elements to make investing more engaging and fun. This can help attract younger investors and encourage them to save more.

Cryptocurrency Integration

As cryptocurrency becomes more mainstream, expect to see more investing apps offering the ability to buy, sell, and store digital assets.

Social Investing

The trend of social investing is likely to continue. Apps will offer more ways to connect with other investors, share ideas, and learn from each other.

Personalized Financial Planning

Investing apps will increasingly offer personalized financial planning tools. These tools can help you create a budget, track your spending, and plan for retirement.

Conclusion

Choosing the best investing app for beginners in 2025 is a crucial first step towards building your financial future. Consider your goals, risk tolerance, and level of knowledge to find an app that fits your needs. Remember to start small, diversify your investments, and stay informed. With the right tools and a solid plan, anyone can achieve their financial goals. So, what are your experiences with investing apps? Share your thoughts and let’s learn from each other!

FAQ

1. What is the best investing app for beginners with no money?

Several apps like Robinhood, Acorns, and Webull offer the ability to start investing with very little money. Some even offer fractional shares, allowing you to buy a portion of a stock for as little as $1.

2. Are investing apps safe to use?

Yes, most reputable investing apps are safe to use. Look for apps that are regulated by financial authorities like the SEC or FINRA and that use strong security measures, such as two-factor authentication and encryption.

3. Can I lose money using an investing app?

Yes, it’s possible to lose money when investing. All investments carry risk, and the value of your investments can fluctuate. It’s important to understand the risks involved before investing and to only invest money that you can afford to lose.