Ever feel like your investments should do more than just grow your bank account? What if you could invest in companies that are actively making the world a better place? That’s where ESG investing basics for beginners come in, offering a way to align your money with your values.

This guide will break down everything you need to know to get started, from understanding what ESG actually means to building a portfolio that reflects your personal ethics. Let’s dive in!

What is ESG Investing?

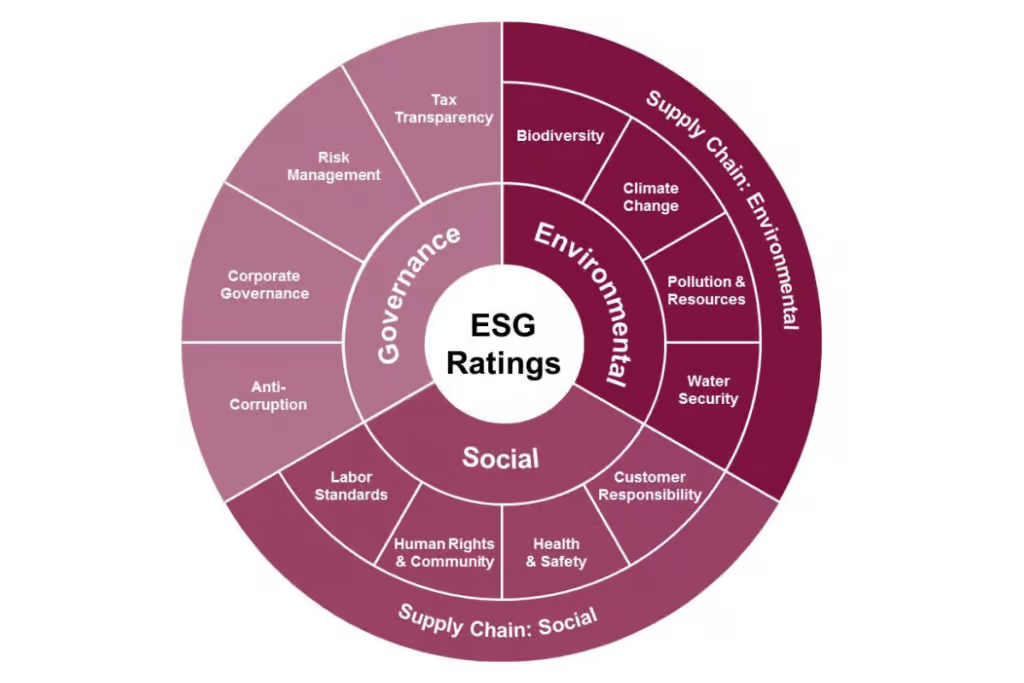

ESG investing is a strategy that considers environmental, social, and governance factors alongside traditional financial metrics when making investment decisions. It’s about looking beyond the bottom line to assess a company’s impact on the world.

It’s a growing trend, driven by investors who want their money to contribute to positive change.

Environmental Factors

Environmental factors examine a company’s impact on the planet.

This includes things like:

- Carbon emissions

- Waste management

- Use of natural resources

- Pollution control

- Renewable energy initiatives

Companies with strong environmental practices are often seen as more sustainable and resilient in the long run.

Social Factors

Social factors assess a company’s relationships with its employees, customers, suppliers, and the communities where it operates.

Key considerations include:

- Labor standards

- Diversity and inclusion

- Human rights

- Customer satisfaction

- Community engagement

A company that treats its stakeholders well is more likely to build a positive reputation and foster long-term success.

Governance Factors

Governance factors focus on a company’s leadership, ethics, and internal controls.

This includes:

- Board structure and independence

- Executive compensation

- Shareholder rights

- Transparency and accountability

- Ethical business practices

Strong governance practices can help prevent fraud, corruption, and other risks that could damage a company’s value.

Why Choose ESG Investing?

There are several compelling reasons to consider ESG investing. It goes beyond simply generating financial returns.

It’s about making a difference while still achieving your financial goals.

Aligning Values with Investments

One of the biggest draws of ESG investing is the ability to align your investments with your personal values.

If you care about climate change, you can invest in companies that are working to reduce their carbon footprint. If you’re passionate about social justice, you can support companies that prioritize diversity and inclusion.

Potential for Competitive Returns

Contrary to popular belief, ESG investing doesn’t necessarily mean sacrificing returns.

In fact, many studies have shown that companies with strong ESG practices often perform better financially over the long term. This is because they are typically better managed, more innovative, and less exposed to risks.

Mitigating Risks

ESG factors can also help investors identify and mitigate risks that might not be apparent from traditional financial analysis.

For example, a company with poor environmental practices may face regulatory fines, lawsuits, or reputational damage that could negatively impact its stock price.

Driving Positive Change

By investing in companies with strong ESG practices, you can help drive positive change in the world.

Your investment dollars can support companies that are working to protect the environment, promote social justice, and improve corporate governance.

Getting Started with ESG Investing: A Step-by-Step Guide

Ready to dive into ESG investing basics for beginners? Here’s a step-by-step guide to help you get started.

It’s easier than you think!

Step 1: Define Your ESG Goals

The first step is to define your ESG goals. What issues are most important to you?

Do you want to focus on climate change, social justice, or corporate governance? Consider what values you want your investments to reflect.

Step 2: Research ESG Funds and Companies

Once you know your ESG goals, it’s time to research ESG funds and companies.

There are many resources available to help you evaluate the ESG performance of different investments, including:

- ESG Ratings Agencies: Companies like MSCI, Sustainalytics, and RepRisk provide ESG ratings for thousands of companies and funds.

- Fund Prospectuses: ESG funds typically disclose their ESG criteria and holdings in their prospectuses.

- Company Sustainability Reports: Many companies publish sustainability reports that detail their ESG performance.

Step 3: Choose Your Investment Vehicles

There are several ways to invest in ESG, including:

- ESG Mutual Funds: These funds invest in a diversified portfolio of companies with strong ESG practices.

- ESG Exchange-Traded Funds (ETFs): Similar to mutual funds, but they trade on stock exchanges like individual stocks.

- Individual Stocks: You can invest directly in companies that align with your ESG goals.

- Green Bonds: These bonds are issued to finance environmentally friendly projects.

- Impact Investments: These investments are made with the intention of generating a measurable social or environmental impact alongside financial returns.

Step 4: Build a Diversified Portfolio

Like any investment strategy, it’s important to build a diversified portfolio when ESG investing.

Don’t put all your eggs in one basket. Spread your investments across different sectors, industries, and asset classes to reduce risk.

Step 5: Monitor and Rebalance Your Portfolio

Once you’ve built your ESG portfolio, it’s important to monitor its performance and rebalance it periodically.

This means reviewing your holdings regularly to ensure they still align with your ESG goals and adjusting your portfolio as needed to maintain your desired asset allocation.

Types of ESG Investment Strategies

There are several different approaches to ESG investing, each with its own unique focus and methodology.

Understanding these strategies can help you choose the right approach for your goals and values.

Negative Screening

Negative screening involves excluding companies or industries that are involved in activities that you find objectionable.

This might include companies that produce weapons, tobacco, or fossil fuels.

Positive Screening

Positive screening involves actively seeking out and investing in companies that are leaders in ESG performance.

This might include companies that are developing renewable energy technologies, promoting diversity and inclusion, or implementing strong corporate governance practices.

Best-in-Class

The best-in-class approach involves investing in the companies with the highest ESG ratings within each sector or industry.

This allows you to invest in a diversified portfolio while still prioritizing ESG performance.

Impact Investing

Impact investing involves making investments with the intention of generating a measurable social or environmental impact alongside financial returns.

This might include investing in companies that are providing affordable housing, clean water, or healthcare to underserved communities.

Thematic Investing

Thematic investing involves focusing on specific ESG themes, such as climate change, water scarcity, or gender equality.

This allows you to target your investments towards areas that you are particularly passionate about.

Common Misconceptions About ESG Investing

There are several common misconceptions about ESG investing that can deter people from getting started.

Let’s debunk some of these myths.

Myth #1: ESG Investing Sacrifices Returns

As mentioned earlier, this is a common misconception.

Many studies have shown that companies with strong ESG practices often perform better financially over the long term.

Myth #2: ESG Investing is Only for the Wealthy

ESG investing is accessible to everyone, regardless of their income or net worth.

There are many low-cost ESG funds and ETFs available that make it easy to get started with a small amount of money.

Myth #3: ESG Investing is Too Complicated

While it’s true that ESG investing involves some research and analysis, it doesn’t have to be overly complicated.

There are many resources available to help you evaluate the ESG performance of different investments, and you can always seek advice from a financial advisor.

Myth #4: ESG Investing is Just a Fad

ESG investing is not a fad. It’s a growing trend that is being driven by increasing awareness of the social and environmental challenges facing the world.

As more and more investors demand sustainable and responsible investments, ESG investing is likely to become even more mainstream in the years to come.

Tools and Resources for ESG Investors

Navigating the world of ESG investing basics for beginners can be easier with the right tools and resources.

Here are a few helpful options.

ESG Ratings Agencies

- MSCI: Provides ESG ratings and research for companies and funds.

- Sustainalytics: Offers ESG risk ratings and analysis.

- RepRisk: Specializes in identifying and assessing ESG risks.

Online Brokers and Investment Platforms

- Schwab: Offers a variety of ESG funds and ETFs.

- Fidelity: Provides access to ESG research and investment options.

- Betterment: A robo-advisor that offers socially responsible investing options.

Websites and Publications

- GreenBiz: A leading source of news and information on sustainable business.

- Sustainable Brands: A community of brand leaders focused on sustainability.

- Environmental Leader: Covers environmental news and trends.

Financial Advisors

A financial advisor who specializes in ESG investing can provide personalized guidance and help you build a portfolio that aligns with your goals and values.

Overcoming Challenges in ESG Investing

While ESG investing offers many benefits, it also presents some challenges.

Here are a few common challenges and how to overcome them.

Lack of Standardized ESG Data

One of the biggest challenges in ESG investing is the lack of standardized ESG data.

Different ESG ratings agencies use different methodologies, which can make it difficult to compare the ESG performance of different companies and funds. To overcome this challenge, it’s important to look at multiple sources of ESG data and to understand the methodologies used by each ratings agency.

Greenwashing

Greenwashing is the practice of exaggerating or misrepresenting a company’s ESG performance.

This can make it difficult to identify truly sustainable and responsible investments. To avoid greenwashing, it’s important to do your own research and to be skeptical of companies that make unsubstantiated claims about their ESG performance.

Limited Investment Options

While the number of ESG investment options has grown significantly in recent years, it is still more limited than the universe of traditional investments.

This can make it challenging to build a diversified ESG portfolio. To overcome this challenge, it’s important to be flexible and to consider a range of ESG investment strategies.

The Future of ESG Investing

ESG investing is poised for continued growth in the years to come.

Several factors are driving this trend, including:

- Increasing Awareness of ESG Issues: As more and more people become aware of the social and environmental challenges facing the world, they are increasingly demanding sustainable and responsible investments.

- Growing Demand from Millennials and Gen Z: Millennials and Gen Z are particularly interested in ESG investing, and they are expected to drive much of the growth in this area in the coming years.

- Regulatory Developments: Governments around the world are increasingly implementing regulations that promote ESG investing.

- Improved ESG Data and Analytics: As ESG data and analytics become more sophisticated, it will become easier for investors to evaluate the ESG performance of different companies and funds.

Conclusion

ESG investing basics for beginners might seem daunting at first, but it’s a rewarding journey. By understanding the core principles, exploring different strategies, and utilizing available resources, you can build a portfolio that not only grows your wealth but also contributes to a better world.

Take the first step today, explore your options, and start aligning your investments with your values. What are your thoughts on ESG investing? Share your experiences and questions below!

FAQ Section

Q1: What is the difference between ESG investing and socially responsible investing (SRI)?

A1: While the terms are often used interchangeably, ESG investing is a broader approach that considers a wider range of environmental, social, and governance factors. SRI typically focuses on excluding companies involved in specific activities, such as tobacco or weapons. ESG investing can include both negative screening and positive selection based on a company’s overall ESG performance.

Q2: How can I tell if an ESG fund is truly aligned with my values?

A2: Start by carefully reviewing the fund’s prospectus and fact sheet to understand its ESG criteria and investment strategy. Look for details on how the fund incorporates ESG factors into its investment decisions and what types of companies it excludes or favors. Also, consider checking the fund’s ESG rating from independent agencies like MSCI or Sustainalytics.

Q3: Is ESG investing more expensive than traditional investing?

A3: Not necessarily. While some ESG funds may have slightly higher expense ratios due to the additional research and analysis involved, there are also many low-cost ESG ETFs and mutual funds available. The key is to shop around and compare the expense ratios of different ESG options to find one that fits your budget.