Ever feel like Wall Street is speaking a different language? You’re not alone. Many struggle to understand the nuances of investing, especially when deciding between actively managing your portfolio and letting it ride with a more hands-off approach.

This Passive Investing vs Active Investing Guide will break down the jargon and help you determine which strategy aligns best with your financial goals, risk tolerance, and lifestyle. Let’s dive in and demystify the world of investing.

Understanding Active Investing

Active investing is like being the conductor of your own financial orchestra. It requires a hands-on approach where you or a fund manager actively buy and sell investments with the goal of outperforming the market.

What is Active Investing?

Active investing involves actively selecting specific investments. The goal is to beat a benchmark index, such as the S&P 500. This often requires significant research and analysis.

Think of it as picking individual stocks or bonds that you believe will perform better than the average. It’s a more involved strategy that demands time, effort, and expertise.

How Active Investing Works

Active investors use various strategies to identify promising investments. This could involve analyzing financial statements, tracking economic trends, or using technical analysis.

They constantly monitor their portfolios, making adjustments as needed based on market conditions and their own research. This frequent trading aims to capitalize on short-term opportunities and maximize returns.

Pros of Active Investing

- Potential for Higher Returns: Active management offers the possibility of outperforming the market. Skilled investors can identify undervalued assets and capitalize on market inefficiencies.

- Flexibility: Active investors can quickly adapt to changing market conditions. They can shift their portfolios to take advantage of new opportunities or mitigate risks.

- Control: You have direct control over your investment decisions. This allows you to align your investments with your personal values and financial goals.

Cons of Active Investing

- Higher Costs: Active management typically involves higher fees. This includes management fees, transaction costs, and potentially performance fees.

- Time Commitment: Active investing requires a significant time commitment. You need to dedicate time to research, analysis, and monitoring your portfolio.

- Risk of Underperformance: There’s no guarantee that active management will beat the market. In fact, many active managers consistently underperform their benchmarks.

Exploring Passive Investing

Passive investing is like setting sail and letting the currents guide you. It’s a more relaxed approach focused on long-term growth and minimizing costs.

What is Passive Investing?

Passive investing involves investing in a diversified portfolio that mirrors a specific market index. The goal is to match the market’s performance rather than trying to beat it.

This is typically achieved through index funds or exchange-traded funds (ETFs) that track the performance of a particular index. It’s a simpler, less time-consuming approach.

How Passive Investing Works

Passive investors typically buy and hold index funds or ETFs. These funds automatically rebalance their holdings to maintain their alignment with the underlying index.

The strategy focuses on long-term growth and minimizing turnover. This reduces transaction costs and potential tax implications.

Pros of Passive Investing

- Lower Costs: Passive investing typically involves lower fees. Index funds and ETFs have lower expense ratios compared to actively managed funds.

- Diversification: Passive investing provides instant diversification across a broad range of assets. This reduces the risk associated with investing in individual stocks or bonds.

- Simplicity: Passive investing is a simpler and more straightforward approach. It requires less time and effort compared to active management.

- Tax Efficiency: Lower turnover rates in passive funds often result in fewer taxable events. This can help you minimize your tax burden.

Cons of Passive Investing

- Limited Upside Potential: Passive investing aims to match the market’s performance, not beat it. You won’t experience outsized returns compared to the market average.

- Lack of Control: You have limited control over the specific investments in your portfolio. You’re essentially investing in the entire index, regardless of your individual preferences.

- Market Exposure: Passive investing exposes you to the overall market risk. If the market declines, your portfolio will likely decline as well.

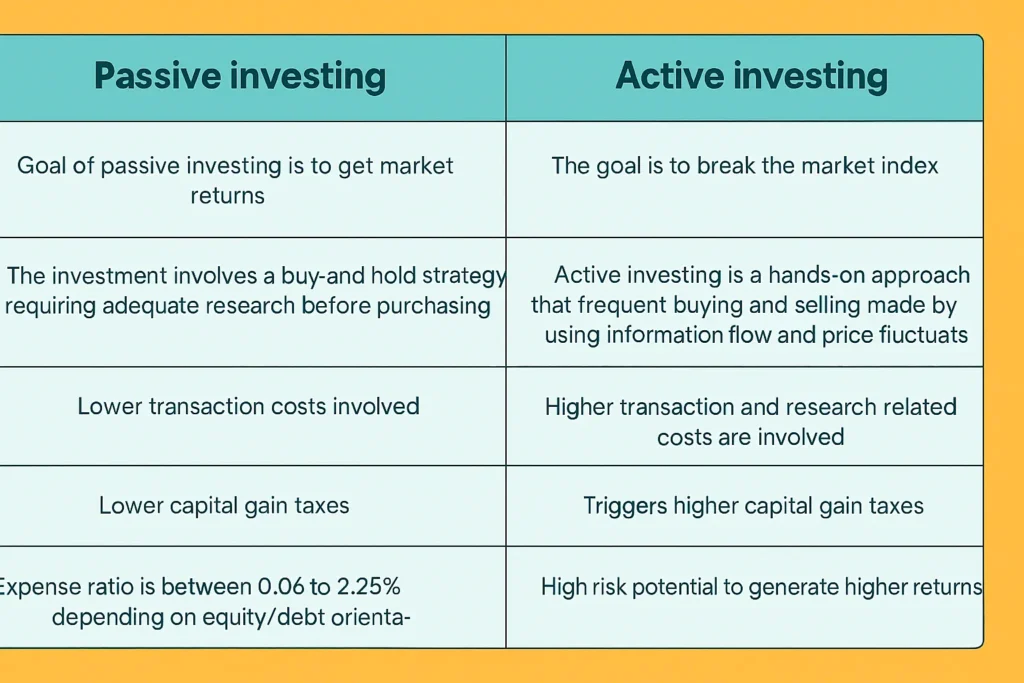

Active Investing vs Passive Investing: Key Differences

Choosing between active and passive investing depends on your investment goals, risk tolerance, and time commitment. Let’s break down the key differences to help you make an informed decision.

Fees and Expenses

- Active Investing: Higher fees due to management fees, transaction costs, and potential performance fees.

- Passive Investing: Lower fees due to lower expense ratios of index funds and ETFs.

Time Commitment

- Active Investing: Requires significant time for research, analysis, and monitoring.

- Passive Investing: Requires minimal time and effort; a buy-and-hold strategy.

Potential Returns

- Active Investing: Potential for higher returns by outperforming the market.

- Passive Investing: Aims to match the market’s performance.

Risk

- Active Investing: Risk of underperforming the market; higher volatility potential.

- Passive Investing: Market risk; portfolio performance mirrors the market.

Control

- Active Investing: Direct control over investment decisions.

- Passive Investing: Limited control; investments mirror the index.

Choosing the Right Strategy for You

Selecting the right investment strategy requires careful consideration of your personal circumstances and financial goals.

Assess Your Risk Tolerance

- Active Investing: Suitable for investors with a higher risk tolerance who are comfortable with potential volatility.

- Passive Investing: Suitable for investors with a lower risk tolerance who prefer a more stable, long-term approach.

Consider Your Time Horizon

- Active Investing: May be suitable for shorter time horizons if you believe you can identify short-term opportunities.

- Passive Investing: Generally more suitable for longer time horizons, allowing for compounding returns over time.

Evaluate Your Financial Goals

- Active Investing: If your goal is to achieve above-average returns, active investing may be worth considering.

- Passive Investing: If your goal is to achieve steady, long-term growth, passive investing is a solid choice.

Determine Your Time Commitment

- Active Investing: If you have the time and interest to dedicate to research and analysis, active investing may be appealing.

- Passive Investing: If you prefer a more hands-off approach, passive investing is a better fit.

The Hybrid Approach: Combining Active and Passive Strategies

Some investors choose to combine both active and passive strategies in their portfolios. This hybrid approach allows them to benefit from the potential upside of active management while still maintaining the diversification and cost-effectiveness of passive investing.

How to Implement a Hybrid Strategy

- Core-Satellite Approach: Use passive investments as the core of your portfolio and supplement with active investments as satellite holdings.

- Allocate a Percentage: Allocate a certain percentage of your portfolio to active investments and the remainder to passive investments.

Benefits of a Hybrid Approach

- Diversification: Combines the diversification benefits of passive investing with the potential for higher returns from active management.

- Risk Management: Allows you to manage risk by allocating a larger portion of your portfolio to passive investments.

- Flexibility: Provides the flexibility to adjust your allocation based on market conditions and your own investment goals.

Practical Examples of Active and Passive Investing

To better understand the difference, let’s look at some practical examples of how active and passive investing might play out in real-world scenarios.

Active Investing Example

Imagine you believe that the technology sector is poised for significant growth. As an active investor, you might research individual tech companies, analyze their financial statements, and select a few that you believe will outperform their peers.

You would then actively monitor your investments, making adjustments as needed based on market developments and company-specific news. This approach requires ongoing effort and a deep understanding of the technology sector.

Passive Investing Example

Alternatively, as a passive investor, you might choose to invest in a technology-focused index fund or ETF. This fund would automatically track the performance of a broad range of technology companies, providing instant diversification.

You would simply buy and hold the fund, allowing it to grow over time without actively managing the individual holdings. This approach requires minimal effort and provides exposure to the technology sector as a whole.

Common Mistakes to Avoid

Whether you choose active or passive investing, there are some common mistakes to avoid.

Active Investing Mistakes

- Chasing Hot Stocks: Investing in stocks based on recent performance or hype, rather than fundamental analysis.

- Emotional Investing: Making investment decisions based on fear or greed, rather than rational analysis.

- Overtrading: Trading too frequently, resulting in higher transaction costs and potential tax implications.

Passive Investing Mistakes

- Ignoring Asset Allocation: Failing to diversify your portfolio across different asset classes.

- Market Timing: Trying to predict market movements and buy or sell based on those predictions.

- Panic Selling: Selling your investments during market downturns, rather than staying the course.

Resources for Further Learning

To continue your investing education, consider exploring these resources.

Books

- “The Intelligent Investor” by Benjamin Graham

- “A Random Walk Down Wall Street” by Burton Malkiel

- “The Little Book of Common Sense Investing” by John C. Bogle

Websites

- Investopedia

- Morningstar

- The Motley Fool

Online Courses

- Coursera

- edX

- Khan Academy

Conclusion

Choosing between passive investing vs active investing is a personal decision that depends on your unique circumstances. Active investing offers the potential for higher returns but requires more time, effort, and expertise. Passive investing provides a simpler, lower-cost approach with broad diversification.

Consider your risk tolerance, time horizon, financial goals, and time commitment when making your decision. A hybrid approach can also be a viable option. No matter which strategy you choose, remember to stay informed, avoid common mistakes, and focus on long-term growth.

What are your experiences with active or passive investing? Feel free to share your thoughts and questions in the comments below!

FAQ

Q: Is active investing always better than passive investing if I want higher returns?

A: Not necessarily. While active investing can potentially yield higher returns, it also carries a higher risk of underperforming the market. Many studies show that the majority of active managers fail to beat their benchmarks over the long term, especially after accounting for fees.

Q: What’s the best way to get started with passive investing?

A: The easiest way to start passive investing is by opening a brokerage account and investing in low-cost index funds or ETFs that track broad market indexes like the S&P 500 or the total stock market. Consider setting up automatic investments to consistently contribute to your portfolio.

Q: How often should I rebalance my portfolio if I’m using a passive investing strategy?

A: A good rule of thumb is to rebalance your portfolio annually or whenever your asset allocation deviates significantly from your target allocation (e.g., more than 5%). Rebalancing helps maintain your desired risk level and ensures your portfolio stays aligned with your long-term goals.