Ever feel like the stock market is speaking a different language? You hear terms like “value investing” and “growth investing” tossed around, but what do they actually mean?

Picking the right investment strategy can feel overwhelming. Don’t worry, you’re not alone! This article breaks down the differences between value investing and growth investing, offering practical tips to help you choose the best approach for your financial goals.

Value Investing vs. Growth Investing: Understanding the Basics

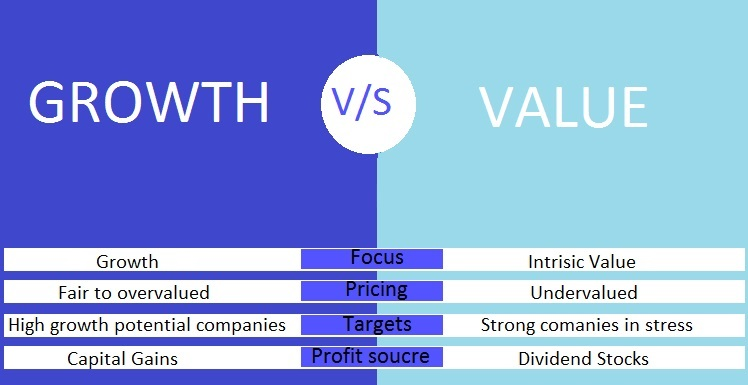

Value investing and growth investing represent two fundamentally different philosophies in the stock market. Understanding these differences is crucial for making informed investment decisions. Let’s delve into the core principles of each approach.

What is Value Investing?

Value investing is like finding a hidden gem at a garage sale. It focuses on identifying undervalued stocks. These are companies that the market has seemingly overlooked, trading at a price lower than their intrinsic value.

Think of it as buying a dollar for 50 cents. Value investors believe that the market will eventually recognize the true worth of these companies, leading to a price correction and profit.

What is Growth Investing?

Growth investing, on the other hand, is about betting on future potential. It involves investing in companies that are expected to grow at a significantly faster rate than the overall market.

These companies often reinvest their earnings to fuel further expansion. Growth investors are willing to pay a premium for these stocks, anticipating substantial returns in the long run.

Key Differences Between Value and Growth Investing

The contrast between value and growth investing extends beyond their core principles. Here’s a detailed comparison of their key differences:

Investment Focus

Value investors prioritize companies with strong fundamentals but low valuations. They look for metrics like low price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and high dividend yields.

Growth investors focus on companies with high revenue growth, earnings growth, and innovative products or services. They are less concerned with current valuations and more focused on future growth prospects.

Risk Tolerance

Value investing is generally considered a more conservative approach. Undervalued stocks often have a margin of safety built in, reducing the potential for significant losses.

Growth investing tends to be riskier. High-growth companies are often more volatile and susceptible to market fluctuations. Their future success is also less certain.

Time Horizon

Value investing typically requires a longer time horizon. It can take time for the market to recognize the true value of undervalued stocks.

Growth investing can potentially yield faster returns, but it also requires patience. Sustained growth takes time, and there can be periods of underperformance.

Company Characteristics

Value stocks are often found in mature industries or companies facing temporary challenges. They may be unglamorous but have a solid track record and strong cash flow.

Growth stocks are typically found in emerging industries or companies disrupting existing markets. They are often innovative and have the potential to become market leaders.

Valuation Metrics

Value investors rely on traditional valuation metrics like P/E ratio, P/B ratio, and dividend yield. They compare these metrics to industry averages and historical data to identify undervalued stocks.

Growth investors may use different metrics, such as price-to-sales (P/S) ratio or price-to-earnings growth (PEG) ratio. They also consider factors like market share, customer acquisition costs, and the potential for future growth.

Value Investing Tips for Beginners

If you’re drawn to the principles of value investing, here are some tips to help you get started:

Research Thoroughly

Don’t just buy a stock because it looks cheap. Dig into the company’s financials, understand its business model, and assess its competitive landscape.

Focus on Fundamentals

Pay attention to key financial metrics like revenue, earnings, cash flow, and debt. Look for companies with a history of profitability and a strong balance sheet.

Look for a Margin of Safety

Buy stocks at a price significantly below their estimated intrinsic value. This provides a buffer against potential errors in your analysis.

Be Patient

Value investing requires patience. It can take time for the market to recognize the true value of undervalued stocks. Don’t panic sell if the stock price doesn’t immediately go up.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversify your portfolio across different sectors and industries to reduce your overall risk.

Understand the Business

Before investing, make sure you understand how the company generates revenue and what its competitive advantages are.

Read Annual Reports

Annual reports provide valuable insights into a company’s performance, strategy, and outlook. Pay attention to the management’s commentary and any potential risks.

Consider Economic Moats

Look for companies with sustainable competitive advantages, such as strong brands, patents, or network effects. These “economic moats” can protect their profits from competitors.

Avoid Emotional Investing

Don’t let your emotions drive your investment decisions. Stick to your research and analysis, and avoid making impulsive trades based on fear or greed.

Learn from the Masters

Study the strategies of successful value investors like Warren Buffett and Benjamin Graham. Learn from their experiences and adapt their principles to your own investment approach.

Growth Investing Tips for Beginners

For those intrigued by the potential of growth investing, here are some tips to navigate this dynamic strategy:

Identify High-Growth Industries

Focus on industries with strong growth potential, such as technology, healthcare, or renewable energy. These industries often offer the best opportunities for growth investors.

Look for Innovative Companies

Invest in companies that are developing innovative products or services that are disrupting existing markets. These companies have the potential to generate significant returns.

Analyze Revenue Growth

Pay close attention to a company’s revenue growth rate. Look for companies that are consistently growing their revenue at a high rate.

Consider Market Share

Invest in companies that are gaining market share in their respective industries. This indicates that they are successfully competing against their rivals.

Assess Management Team

Evaluate the quality of the company’s management team. Look for experienced and capable leaders who have a proven track record of success.

Understand the Business Model

Make sure you understand how the company generates revenue and what its competitive advantages are. A sustainable business model is crucial for long-term growth.

Monitor Key Metrics

Track key metrics like customer acquisition costs, churn rate, and average revenue per user. These metrics can provide valuable insights into the company’s performance.

Be Willing to Pay a Premium

Growth stocks often trade at higher valuations than value stocks. Be prepared to pay a premium for companies with strong growth potential.

Diversify Your Portfolio

Diversify your portfolio across different sectors and industries to reduce your overall risk. Don’t put all your eggs in one basket.

Stay Informed

Keep up to date with the latest news and trends in the industries you are investing in. This will help you make informed investment decisions.

Combining Value and Growth Investing

It’s not an “either/or” situation. Many investors successfully combine elements of both value and growth investing in their portfolios. This hybrid approach seeks to balance risk and reward.

Growth at a Reasonable Price (GARP)

GARP investing focuses on finding companies that are growing at a faster-than-average rate but are still trading at a reasonable valuation. This approach seeks to capture the best of both worlds.

Core-Satellite Investing

This strategy involves building a core portfolio of value stocks and supplementing it with a satellite portfolio of growth stocks. This allows investors to participate in the potential upside of growth stocks while maintaining a stable foundation.

Dynamic Allocation

This approach involves actively adjusting the allocation between value and growth stocks based on market conditions. For example, investors may increase their allocation to value stocks during periods of market volatility and increase their allocation to growth stocks during periods of economic expansion.

Choosing the Right Strategy for You

The best investment strategy depends on your individual circumstances, risk tolerance, and financial goals. Consider the following factors when making your decision:

Risk Tolerance

Are you comfortable with the volatility that comes with growth stocks, or do you prefer the relative stability of value stocks?

Time Horizon

Do you have a long-term investment horizon, or do you need to see results quickly? Value investing typically requires a longer time horizon.

Financial Goals

What are you trying to achieve with your investments? Are you saving for retirement, a down payment on a house, or another specific goal?

Investment Knowledge

How much do you know about the stock market and financial analysis? Value investing requires a deeper understanding of financial statements and valuation techniques.

Personal Preferences

Ultimately, the best investment strategy is one that you are comfortable with and that aligns with your personal values.

Real-World Examples

Let’s look at some real-world examples of companies that might be considered value or growth stocks:

Value Stock Example: Johnson & Johnson (JNJ)

Johnson & Johnson is a large, established company with a strong track record of profitability. It operates in the healthcare sector, which is relatively stable and defensive. It often trades at a lower P/E ratio compared to high-growth tech companies.

Growth Stock Example: Tesla (TSLA)

Tesla is a rapidly growing company in the electric vehicle and renewable energy sectors. It has a high revenue growth rate and a disruptive business model. It often trades at a high P/E ratio due to its growth potential.

Conclusion

Value investing and growth investing offer distinct paths to potentially profitable returns. Understanding their core principles, risk profiles, and time horizons is crucial for making informed investment decisions. Whether you choose to embrace a pure value approach, chase high-growth opportunities, or combine elements of both, remember to research thoroughly, stay disciplined, and align your strategy with your individual goals and risk tolerance.

What are your experiences with value or growth investing? Share your thoughts in the comments below!

FAQ

Here are some frequently asked questions about value investing and growth investing:

What is a good P/E ratio for value investing?

A good P/E ratio for value investing typically falls below the industry average and historical P/E ratios for the company. Generally, a P/E ratio below 15 is often considered attractive for value investors, but it depends on the specific industry and company.

Is growth investing more risky than value investing?

Yes, growth investing is generally considered riskier than value investing. Growth stocks tend to be more volatile and their future success is less certain. Value stocks often have a margin of safety built in, reducing the potential for significant losses.

Can I be both a value investor and a growth investor?

Yes, many investors successfully combine elements of both value and growth investing in their portfolios. This hybrid approach, such as Growth at a Reasonable Price (GARP) or core-satellite investing, seeks to balance risk and reward.