Ever feel like your investments are all riding on the same horse? It’s a scary thought, right? What if that horse stumbles? The key to a less stressful financial future is diversification. Let’s dive into how to build a diversified portfolio easily, and protect your wealth.

How to Build a Diversified Portfolio Easily

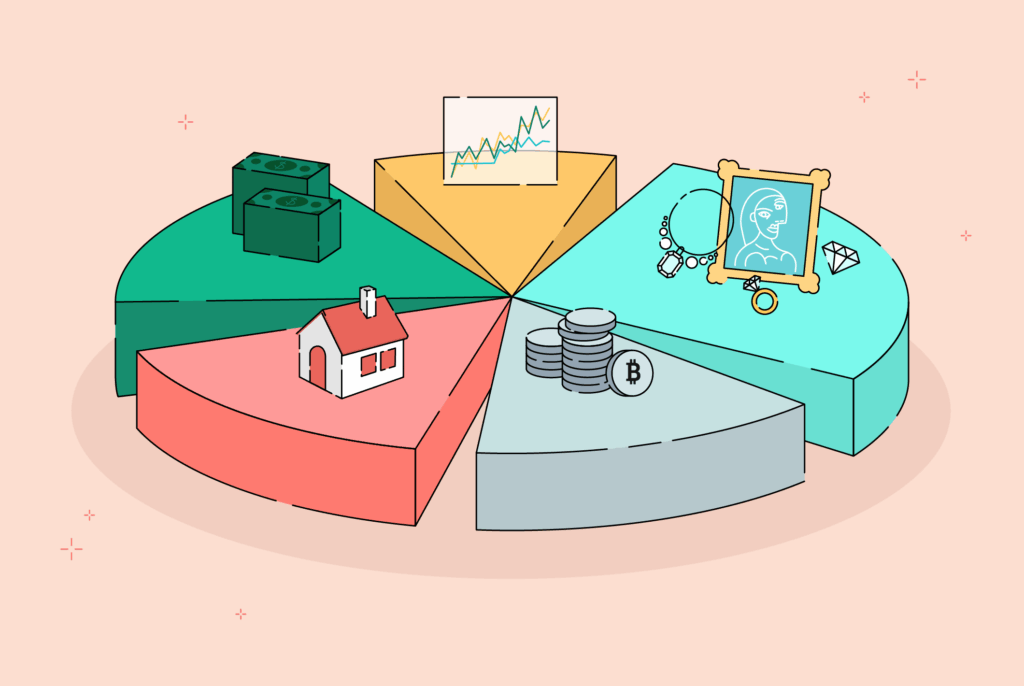

Building a diversified portfolio doesn’t have to be rocket science. It’s about spreading your investments across different asset classes. This way, if one investment performs poorly, others can cushion the blow. Let’s explore the steps to achieve this.

Understanding Asset Allocation

Asset allocation is the cornerstone of any well-diversified portfolio. It involves dividing your investments among different asset classes. These classes typically include stocks, bonds, and cash.

Each asset class has its own risk and return profile. Stocks generally offer higher potential returns but also come with higher risk. Bonds are typically less risky but offer lower returns. Cash is the safest but offers the lowest returns.

The right asset allocation depends on your individual circumstances. These include your risk tolerance, investment goals, and time horizon. A younger investor with a long time horizon might allocate more to stocks. An older investor nearing retirement might allocate more to bonds.

Stocks: A Slice of Ownership

Investing in stocks means owning a piece of a company. Stock prices can fluctuate significantly. This makes them a riskier investment than bonds.

However, stocks have historically provided higher returns over the long term. Diversifying within stocks is also crucial. This means investing in companies of different sizes, industries, and geographic locations.

You can invest in stocks directly by buying individual shares. Or, you can invest indirectly through stock mutual funds or ETFs.

Bonds: Lending to Governments and Corporations

Bonds are essentially loans you make to governments or corporations. They typically pay a fixed interest rate over a set period. Bonds are generally considered less risky than stocks.

They provide stability to a portfolio. Like stocks, it’s important to diversify within bonds. This means investing in bonds with different maturities and credit ratings.

Government bonds are considered safer than corporate bonds. However, corporate bonds usually offer higher yields.

Real Estate: Tangible Assets

Real estate can be a valuable addition to a diversified portfolio. It provides a tangible asset that can appreciate in value.

Real estate investments can include direct ownership of property. It can also include investments in Real Estate Investment Trusts (REITs). REITs are companies that own and operate income-producing real estate.

Real estate can provide diversification benefits. It often has a low correlation with stocks and bonds.

Commodities: Raw Materials

Commodities are raw materials such as oil, gold, and agricultural products. Investing in commodities can provide a hedge against inflation.

Commodity prices often move independently of stocks and bonds. This makes them a useful diversifier.

You can invest in commodities directly through futures contracts. Or, you can invest indirectly through commodity mutual funds or ETFs.

Alternative Investments: Expanding Horizons

Alternative investments include hedge funds, private equity, and venture capital. These investments are typically less liquid and more complex than traditional assets.

They can offer the potential for higher returns. They can also provide diversification benefits.

However, alternative investments are generally only suitable for sophisticated investors. They require a deep understanding of the investment strategy and associated risks.

Steps to Build a Diversified Portfolio Easily

Now that we understand the different asset classes, let’s look at the steps to build a diversified portfolio easily.

Step 1: Determine Your Risk Tolerance

Understanding your risk tolerance is crucial. It will guide your asset allocation decisions. Are you comfortable with the possibility of losing money in exchange for higher potential returns? Or, do you prefer a more conservative approach?

Consider your investment goals and time horizon. A longer time horizon allows you to take on more risk.

Use online risk tolerance questionnaires to help assess your comfort level. Be honest with yourself about your ability to handle market volatility.

Step 2: Set Your Investment Goals

What are you investing for? Retirement? A down payment on a house? Your investment goals will influence your asset allocation.

Clearly define your goals and their time horizons. This will help you stay focused and disciplined.

For example, if you’re saving for retirement in 30 years, you can afford to take on more risk. If you’re saving for a down payment in 5 years, you’ll want a more conservative approach.

Step 3: Choose Your Asset Allocation

Based on your risk tolerance and investment goals, choose an asset allocation strategy. A common starting point is the 60/40 rule. This allocates 60% of your portfolio to stocks and 40% to bonds.

Adjust this allocation based on your individual circumstances. A more aggressive investor might allocate 80% to stocks and 20% to bonds. A more conservative investor might allocate 40% to stocks and 60% to bonds.

Consider rebalancing your portfolio periodically. This ensures that your asset allocation stays aligned with your goals.

Step 4: Select Your Investments

Now it’s time to choose specific investments. You can invest in individual stocks and bonds. Or, you can invest in mutual funds and ETFs.

Mutual funds and ETFs offer instant diversification. They hold a basket of stocks or bonds.

Choose low-cost options to minimize expenses. Expense ratios can eat into your returns over time.

Step 5: Monitor and Rebalance Your Portfolio

Regularly monitor your portfolio’s performance. Make adjustments as needed.

Rebalancing involves selling assets that have performed well. Then, buying assets that have underperformed. This helps maintain your desired asset allocation.

Consider rebalancing annually or when your asset allocation deviates significantly from your target.

Tools to Help Build a Diversified Portfolio Easily

Several tools can help you build a diversified portfolio easily.

Robo-Advisors

Robo-advisors are online platforms that provide automated investment management services. They use algorithms to build and manage your portfolio.

Robo-advisors are a low-cost and convenient option. They are ideal for beginners.

They typically offer a range of portfolio options. These options are based on your risk tolerance and investment goals.

Target-Date Funds

Target-date funds are mutual funds or ETFs that automatically adjust their asset allocation over time. They become more conservative as you approach the target date.

Target-date funds are a simple and hands-off way to build a diversified portfolio. They are ideal for retirement savings.

Choose a target-date fund that corresponds to your expected retirement year.

Online Brokerage Accounts

Online brokerage accounts allow you to buy and sell stocks, bonds, and other investments. They offer a wide range of investment options.

Online brokers typically charge low commissions. They provide research and educational resources.

Choose a reputable online broker with a user-friendly platform.

Common Mistakes to Avoid

Building a diversified portfolio is not without its pitfalls. Here are some common mistakes to avoid.

Concentrating Your Investments

Putting all your eggs in one basket is a recipe for disaster. Avoid concentrating your investments in a single stock or industry.

Diversification is key to mitigating risk. Spread your investments across different asset classes and sectors.

Don’t let emotional attachments cloud your judgment. Invest based on sound financial principles.

Neglecting Rebalancing

Failing to rebalance your portfolio can lead to an imbalanced asset allocation. This can increase your risk.

Regularly rebalance your portfolio to maintain your desired asset allocation. This helps you stay on track towards your goals.

Set a schedule for rebalancing. Stick to it.

Paying High Fees

High fees can eat into your investment returns over time. Choose low-cost investment options.

Pay attention to expense ratios and commissions. These can significantly impact your long-term performance.

Consider index funds and ETFs. They typically have lower fees than actively managed funds.

Trying to Time the Market

Trying to time the market is a fool’s errand. No one can consistently predict market movements.

Instead of trying to time the market, focus on long-term investing. Stay disciplined and stick to your investment plan.

Dollar-cost averaging can help you avoid the temptation to time the market. It involves investing a fixed amount of money at regular intervals.

The Benefits of a Diversified Portfolio

Building a diversified portfolio offers numerous benefits.

Reduced Risk

Diversification reduces risk by spreading your investments across different asset classes. This minimizes the impact of any single investment performing poorly.

A well-diversified portfolio is less volatile. It provides greater peace of mind.

Increased Returns

Diversification can also increase your returns over the long term. By investing in a variety of assets, you can capture growth opportunities in different sectors and markets.

A diversified portfolio can provide a more consistent and reliable return stream.

Protection Against Inflation

Certain asset classes, such as commodities and real estate, can provide a hedge against inflation. They tend to perform well during periods of rising prices.

Including these assets in your portfolio can help protect your purchasing power.

Achieving Financial Goals

A diversified portfolio can help you achieve your financial goals. It provides a solid foundation for long-term wealth creation.

By carefully planning your asset allocation and investment strategy, you can increase your chances of success.

Diversification Strategies for Different Life Stages

Diversification needs can change as you move through different life stages.

Early Career

In your early career, you have a long time horizon. You can afford to take on more risk.

Allocate a larger portion of your portfolio to stocks. Consider investing in growth stocks and emerging markets.

Mid-Career

In your mid-career, you should continue to focus on growth. But, also start to consider more conservative investments.

Gradually increase your allocation to bonds. Consider adding real estate to your portfolio.

Pre-Retirement

As you approach retirement, you should shift your portfolio towards a more conservative allocation.

Reduce your allocation to stocks. Increase your allocation to bonds and cash.

Retirement

In retirement, you need to focus on preserving your capital. Generate income.

Maintain a conservative asset allocation. Consider investing in dividend-paying stocks and bonds.

Conclusion

Building a diversified portfolio easily is essential for long-term financial success. By understanding asset allocation, choosing the right investments, and avoiding common mistakes, you can create a portfolio that aligns with your risk tolerance and investment goals. Remember to monitor and rebalance your portfolio regularly to stay on track.

What are your experiences with diversification? Share your thoughts and strategies in the comments below!

FAQ

Q: What is asset allocation?

A: Asset allocation is the process of dividing your investments among different asset classes, such as stocks, bonds, and cash. It’s the foundation of a diversified portfolio.

Q: How often should I rebalance my portfolio?

A: You should rebalance your portfolio at least annually. Or, when your asset allocation deviates significantly from your target. This ensures that your portfolio stays aligned with your goals.

Q: What are the benefits of using a robo-advisor?

A: Robo-advisors offer automated investment management services at a low cost. They are a convenient option for beginners. They provide diversified portfolios based on your risk tolerance and investment goals.