Ever feel like your investment portfolio is a bit of a rollercoaster? One minute you’re up, the next you’re down. That’s where asset allocation in investing comes into play, acting as your portfolio’s steady hand, guiding you towards smoother, more predictable returns.

Think of it as creating a balanced diet for your investments. You wouldn’t eat only pizza, would you? Similarly, you shouldn’t put all your eggs in one investment basket. In this article, we’ll break down what asset allocation in investing really means and how you can use it to achieve your financial goals.

What Is Asset Allocation in Investing?

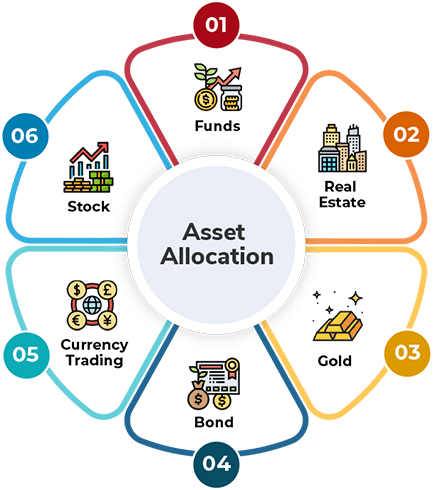

Asset allocation in investing is essentially the process of dividing your investment portfolio among different asset classes, like stocks, bonds, and cash. It’s about finding the right mix of investments that aligns with your risk tolerance, investment goals, and time horizon.

The idea behind asset allocation in investing is that different asset classes perform differently under various market conditions. By diversifying your portfolio, you can reduce your overall risk and potentially improve your returns over time.

Key Components of Asset Allocation

Asset allocation in investing isn’t just throwing darts at a board. It requires careful consideration of several factors.

- Risk Tolerance: How much risk are you comfortable taking? Are you okay with the possibility of losing money in exchange for potentially higher returns, or do you prefer a more conservative approach?

- Investment Goals: What are you saving for? Retirement? A down payment on a house? Your goals will influence the types of assets you choose.

- Time Horizon: How long do you have until you need the money? A longer time horizon allows you to take on more risk, as you have more time to recover from any potential losses.

Why is Asset Allocation Important?

Asset allocation in investing is crucial for a few key reasons:

- Risk Management: It helps to reduce the overall risk of your portfolio by diversifying your investments across different asset classes.

- Return Optimization: It allows you to potentially improve your returns by allocating your investments to asset classes that are expected to perform well.

- Goal Achievement: It helps you to stay on track towards achieving your financial goals by aligning your investments with your specific needs and circumstances.

Understanding Different Asset Classes

Before diving deeper into asset allocation in investing, let’s take a closer look at the major asset classes.

Stocks (Equities)

Stocks represent ownership in a company. They are generally considered to be riskier than bonds, but they also have the potential for higher returns.

- Growth Stocks: These are stocks of companies that are expected to grow at a faster rate than the overall economy.

- Value Stocks: These are stocks of companies that are considered to be undervalued by the market.

- Dividend Stocks: These are stocks of companies that pay out a portion of their profits to shareholders in the form of dividends.

Bonds (Fixed Income)

Bonds are debt instruments issued by corporations or governments. They are generally considered to be less risky than stocks, but they also offer lower potential returns.

- Government Bonds: These are bonds issued by the government. They are generally considered to be the safest type of bond.

- Corporate Bonds: These are bonds issued by corporations. They are generally considered to be riskier than government bonds, but they also offer higher potential returns.

- Municipal Bonds: These are bonds issued by state and local governments. They are often tax-exempt, making them attractive to investors in high tax brackets.

Cash and Cash Equivalents

Cash and cash equivalents include checking accounts, savings accounts, and money market accounts. They are the least risky asset class, but they also offer the lowest returns.

- Checking Accounts: These are accounts used for everyday transactions.

- Savings Accounts: These are accounts used to save money for short-term goals.

- Money Market Accounts: These are accounts that offer higher interest rates than savings accounts, but they also have higher minimum balance requirements.

Alternative Investments

Alternative investments include real estate, commodities, and hedge funds. They are generally considered to be more complex and less liquid than traditional asset classes.

- Real Estate: Investing in properties can provide rental income and potential appreciation.

- Commodities: Investing in raw materials like gold, oil, and agricultural products.

- Hedge Funds: Privately managed investment funds that use various strategies to generate returns.

Factors Influencing Asset Allocation Decisions

Several factors come into play when determining the right asset allocation in investing strategy for you.

Age and Time Horizon

Younger investors with a longer time horizon can typically afford to take on more risk, as they have more time to recover from any potential losses. Older investors with a shorter time horizon may prefer a more conservative approach to asset allocation in investing.

Risk Tolerance

Your risk tolerance is a measure of how comfortable you are with the possibility of losing money. If you are risk-averse, you may prefer a more conservative asset allocation in investing strategy with a higher allocation to bonds and cash. If you are risk-tolerant, you may be comfortable with a more aggressive asset allocation in investing strategy with a higher allocation to stocks.

Financial Goals

Your financial goals will also influence your asset allocation in investing decisions. If you are saving for retirement, you may need a more aggressive asset allocation in investing strategy to grow your investments over time. If you are saving for a short-term goal, such as a down payment on a house, you may prefer a more conservative asset allocation in investing strategy to protect your capital.

Investment Knowledge and Experience

Your investment knowledge and experience can also play a role in your asset allocation in investing decisions. If you are new to investing, you may want to start with a simple asset allocation in investing strategy and gradually increase your complexity as you gain more experience.

Creating Your Asset Allocation Strategy

Now that you understand the key components of asset allocation in investing, let’s look at how to create your own strategy.

Step 1: Assess Your Risk Tolerance

The first step is to assess your risk tolerance. Ask yourself:

- How would I react to a significant market downturn?

- Am I comfortable with the possibility of losing money?

- What is my investment time horizon?

There are many online risk tolerance questionnaires that can help you assess your risk profile.

Step 2: Define Your Investment Goals

Clearly define your investment goals. Are you saving for retirement, a down payment on a house, or your children’s education?

Knowing your goals will help you determine the appropriate time horizon and risk level for your asset allocation in investing strategy.

Step 3: Determine Your Asset Allocation Mix

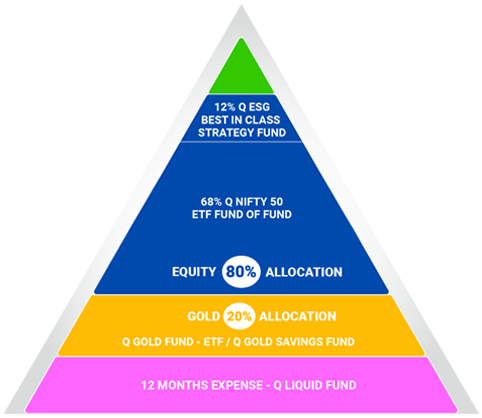

Based on your risk tolerance and investment goals, determine your desired asset allocation in investing mix. Here are a few examples:

- Conservative: 20% Stocks, 70% Bonds, 10% Cash

- Moderate: 50% Stocks, 40% Bonds, 10% Cash

- Aggressive: 80% Stocks, 10% Bonds, 10% Cash

These are just examples, and your specific asset allocation in investing mix will depend on your individual circumstances.

Step 4: Select Specific Investments

Once you have determined your asset allocation in investing mix, you can select specific investments within each asset class.

- Stocks: Consider investing in a diversified stock mutual fund or ETF.

- Bonds: Consider investing in a diversified bond mutual fund or ETF.

- Cash: Keep your cash in a high-yield savings account or money market account.

Step 5: Rebalance Your Portfolio Regularly

Over time, your asset allocation in investing mix may drift away from your target allocation due to market fluctuations. It’s important to rebalance your portfolio regularly to bring it back into alignment.

Rebalancing involves selling some of your investments that have performed well and buying more of the investments that have underperformed. This helps to maintain your desired risk level and ensures that you stay on track towards your financial goals.

Common Asset Allocation Strategies

There are several common asset allocation in investing strategies that investors use.

Target-Date Funds

Target-date funds are designed for investors who are saving for a specific goal, such as retirement. These funds automatically adjust their asset allocation in investing mix over time, becoming more conservative as the target date approaches.

Life-Cycle Funds

Life-cycle funds are similar to target-date funds, but they typically maintain a more consistent asset allocation in investing mix throughout the investor’s life.

Static Asset Allocation

A static asset allocation in investing strategy involves maintaining a fixed asset allocation in investing mix over time, regardless of market conditions.

Dynamic Asset Allocation

A dynamic asset allocation in investing strategy involves adjusting the asset allocation in investing mix based on market conditions and economic forecasts.

Tools and Resources for Asset Allocation

There are many tools and resources available to help you with asset allocation in investing.

Online Calculators

Many websites offer online asset allocation in investing calculators that can help you determine your ideal asset allocation mix based on your risk tolerance, investment goals, and time horizon.

Financial Advisors

A financial advisor can provide personalized advice and guidance on asset allocation in investing. They can help you assess your risk tolerance, define your investment goals, and create a customized asset allocation in investing strategy.

Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to create and manage your asset allocation in investing portfolio. They are a low-cost alternative to traditional financial advisors.

The Importance of Diversification

Diversification is a key principle of asset allocation in investing. It involves spreading your investments across different asset classes, sectors, and geographic regions.

By diversifying your portfolio, you can reduce your overall risk and potentially improve your returns over time.

Benefits of Diversification

- Reduced Risk: Diversification helps to reduce the risk of losing money by spreading your investments across different assets.

- Improved Returns: Diversification can potentially improve your returns by allowing you to participate in the growth of different asset classes.

- Peace of Mind: Diversification can provide peace of mind knowing that your portfolio is not overly concentrated in any one investment.

Mistakes to Avoid in Asset Allocation

Even with a well-thought-out plan, it’s easy to stumble. Here are some common mistakes to avoid in asset allocation in investing.

Ignoring Risk Tolerance

One of the biggest mistakes is ignoring your risk tolerance. Don’t let the potential for high returns tempt you into taking on more risk than you can handle.

Chasing Performance

Another common mistake is chasing performance. Don’t try to time the market by buying high and selling low. Stick to your asset allocation in investing strategy and rebalance your portfolio regularly.

Neglecting Rebalancing

Failing to rebalance your portfolio regularly can lead to your asset allocation in investing mix drifting away from your target allocation. This can increase your risk and potentially reduce your returns.

Over-Diversification

While diversification is important, it’s also possible to over-diversify your portfolio. Owning too many different investments can make it difficult to track your performance and may not significantly reduce your risk.

Conclusion

Asset allocation in investing is a cornerstone of successful investing. By understanding your risk tolerance, setting clear financial goals, and diversifying your investments across different asset classes, you can create a portfolio that is tailored to your individual needs and circumstances. Remember to rebalance your portfolio regularly and avoid common mistakes such as ignoring your risk tolerance and chasing performance.

What are your thoughts on asset allocation in investing? Share your experiences and strategies in the comments below!

FAQ

Q: What is the difference between asset allocation and diversification?

A: Asset allocation in investing is the process of dividing your investment portfolio among different asset classes, while diversification is the practice of spreading your investments within each asset class. They are related but distinct concepts.

Q: How often should I rebalance my portfolio?

A: A good rule of thumb is to rebalance your portfolio at least annually or whenever your asset allocation in investing mix drifts more than 5% from your target allocation.

Q: Is asset allocation a one-time decision?

A: No, asset allocation in investing is not a one-time decision. Your risk tolerance, investment goals, and time horizon may change over time, so it’s important to review and adjust your asset allocation in investing strategy accordingly.