Feeling overwhelmed by the thought of tackling your student loans after graduation? You’re definitely not alone.

Figuring out the best way to manage your debt can feel like navigating a maze, especially with changes on the horizon. Let’s cut through the confusion and explore your student loan repayment options 2025, making the process a whole lot less daunting.

Understanding the Landscape of Student Loan Repayment in 2025

The world of student loans is constantly evolving. What worked last year might not be the best strategy moving forward.

Staying informed about the latest updates and potential policy changes is crucial for making smart financial decisions. Let’s dive into what you need to know about navigating your student loan repayment options 2025.

Federal vs. Private Loans: Knowing the Difference

First things first, it’s important to understand the type of student loans you have. Are they federal or private?

Federal loans are backed by the government and typically offer more flexible repayment options. Private loans, on the other hand, are issued by banks or other financial institutions and usually have fewer options for relief.

Key Changes and Updates to Watch For

Keep an eye on any legislative updates or policy changes that could impact your student loan repayment options 2025. Government programs and regulations can change, so staying informed is key.

Follow reputable sources like the Department of Education and financial aid websites for the latest news.

Exploring Federal Student Loan Repayment Options 2025

Federal student loans offer a range of repayment plans designed to fit different financial situations. Let’s take a look at some of the most common options available to you in 2025.

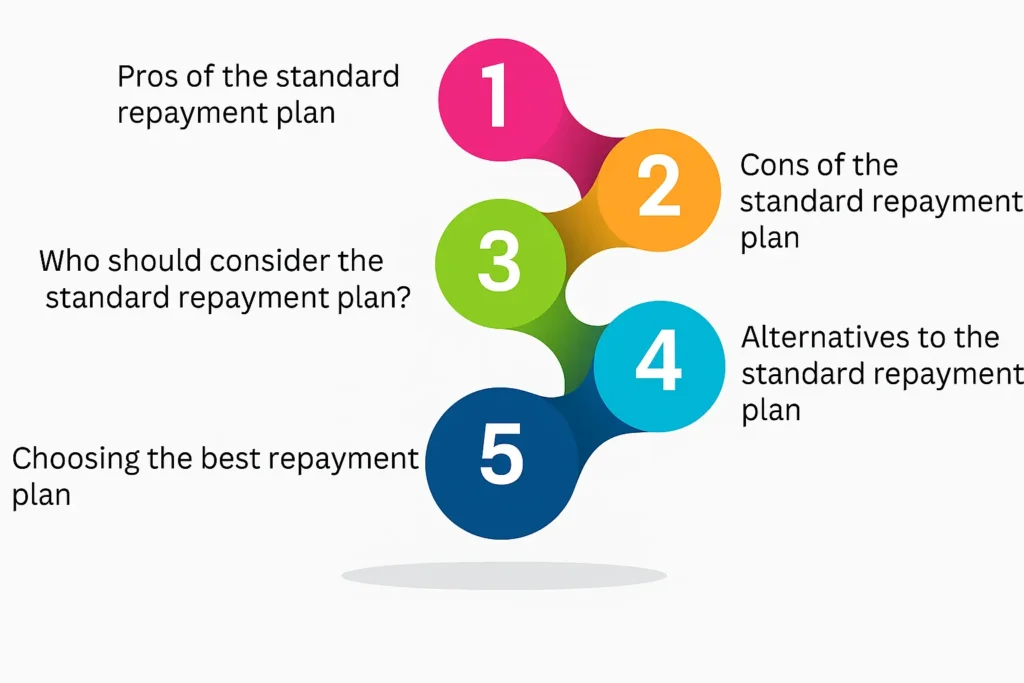

Standard Repayment Plan

The standard repayment plan is the most straightforward option. You’ll make fixed monthly payments for up to 10 years.

This plan is often the quickest way to pay off your loans, but it may not be the most affordable if you’re on a tight budget.

Graduated Repayment Plan

The graduated repayment plan starts with lower monthly payments that gradually increase over time, usually every two years. This can be a good option if you expect your income to rise steadily.

The repayment period is still typically 10 years, similar to the standard plan.

Extended Repayment Plan

If you need more time to repay your loans, the extended repayment plan might be a good fit. This plan allows you to stretch out your payments for up to 25 years.

While this reduces your monthly payment, you’ll end up paying more in interest over the life of the loan.

Income-Driven Repayment (IDR) Plans

Income-driven repayment plans are designed to make your monthly payments more manageable based on your income and family size. These plans can significantly lower your payments, especially if you have a lower income.

Several IDR plans are available, each with its own eligibility requirements and terms.

Saving on a Valuable Education (SAVE) Plan

The SAVE plan is one of the most popular IDR options. It calculates your monthly payment based on your discretionary income and forgives any remaining balance after a certain number of years.

This plan is particularly beneficial for borrowers with lower incomes relative to their debt.

Income-Based Repayment (IBR) Plan

The IBR plan also bases your monthly payment on your income and family size. Under this plan, your monthly payments are typically capped at 10% or 15% of your discretionary income.

Any remaining balance is forgiven after 20 or 25 years of qualifying payments.

Income-Contingent Repayment (ICR) Plan

The ICR plan is another IDR option that adjusts your monthly payments based on your income. This plan is available to borrowers with eligible federal student loans.

Payments are calculated as either 20% of your discretionary income or what you would pay on a fixed 12-year repayment plan, whichever is lower. Any remaining balance is forgiven after 25 years.

Pay As You Earn (PAYE) Plan

The PAYE plan caps your monthly payments at 10% of your discretionary income. To qualify, you must be a new borrower as of October 1, 2007, and have received a Direct Loan disbursement after October 1, 2011.

Any remaining balance is forgiven after 20 years of qualifying payments.

Loan Forgiveness Programs

Several loan forgiveness programs are available for borrowers who meet specific criteria. These programs can help you eliminate your student loan debt entirely.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness program is designed for borrowers who work full-time for a qualifying non-profit organization or government agency. After making 120 qualifying monthly payments, the remaining balance of your Direct Loans can be forgiven.

This program can be a game-changer for those working in public service.

Teacher Loan Forgiveness

Teachers who work full-time for five consecutive years in a low-income school may be eligible for teacher loan forgiveness. Depending on the subject they teach, they may be able to have up to $17,500 of their Direct Loans or FFEL loans forgiven.

This program is a great incentive for educators committed to serving communities in need.

Other Loan Forgiveness Options

Depending on your profession or circumstances, other loan forgiveness programs may be available. Research options specific to your field, such as programs for healthcare professionals or those serving in the military.

Navigating Private Student Loan Repayment Options 2025

Private student loans typically offer fewer repayment options than federal loans. However, there are still strategies you can use to manage your debt effectively.

Refinancing Your Private Student Loans

Refinancing involves taking out a new loan to pay off your existing private student loans. This can be a good option if you can qualify for a lower interest rate or more favorable terms.

Shop around for the best rates and terms from different lenders.

Negotiating with Your Lender

Some private lenders may be willing to work with you if you’re struggling to make your payments. Contact your lender to discuss your options, such as temporary forbearance or a reduced payment plan.

It’s always worth exploring your options, even if they seem limited.

Consolidation

Consolidating your private student loans can simplify your repayment process by combining multiple loans into a single loan with one monthly payment. This may not necessarily lower your interest rate, but it can make it easier to manage your debt.

Strategies for Managing Student Loan Repayment in 2025

Regardless of whether you have federal or private student loans, there are several strategies you can use to manage your repayment effectively.

Creating a Budget

Creating a budget is essential for managing your finances and prioritizing your student loan payments. Track your income and expenses to see where you can cut back and allocate more funds to your loans.

A well-thought-out budget can help you stay on track and avoid financial stress.

Prioritizing High-Interest Debt

If you have multiple student loans with varying interest rates, prioritize paying off the loans with the highest interest rates first. This can save you money in the long run by reducing the amount of interest you pay over the life of the loan.

Consider using the debt avalanche or debt snowball method to tackle your debt strategically.

Automating Payments

Automating your student loan payments can help you avoid missed payments and late fees. Many lenders offer a discount for enrolling in autopay.

Setting up automatic payments can also help you stay on track with your repayment goals.

Seeking Financial Counseling

If you’re feeling overwhelmed by your student loan debt, consider seeking help from a financial counselor. They can provide personalized advice and guidance on managing your debt and developing a repayment plan that works for you.

Non-profit organizations often offer free or low-cost financial counseling services.

Exploring Deferment and Forbearance

Deferment and forbearance are temporary options that allow you to postpone your student loan payments. Deferment is typically available for borrowers who are experiencing financial hardship, while forbearance is available for borrowers who are facing other temporary challenges.

Keep in mind that interest may continue to accrue during deferment and forbearance, increasing the total amount you owe.

Tips for Staying Informed About Student Loan Repayment Options 2025

Staying informed about the latest updates and changes in student loan repayment options is crucial for making smart financial decisions.

Subscribe to Newsletters and Alerts

Sign up for newsletters and email alerts from reputable sources like the Department of Education and financial aid websites. This will ensure you receive timely updates on policy changes and new repayment options.

Follow Reputable Sources on Social Media

Follow reputable financial aid organizations and experts on social media. This can be a convenient way to stay informed about the latest news and trends in student loan repayment.

Attend Webinars and Workshops

Attend webinars and workshops on student loan repayment. These events can provide valuable insights and guidance on navigating your options.

Consult with a Financial Advisor

Consider consulting with a financial advisor who specializes in student loan repayment. They can provide personalized advice based on your individual circumstances.

Student Loan Repayment Options 2025: Key Considerations

As you explore your student loan repayment options 2025, keep the following considerations in mind:

- Your Income and Expenses: Evaluate your current income and expenses to determine how much you can afford to pay each month.

- Your Loan Balance and Interest Rates: Consider the total amount you owe and the interest rates on your loans.

- Your Career Goals: Think about your long-term career goals and how your student loan repayment plan will impact your ability to achieve them.

- Potential Policy Changes: Stay informed about any potential policy changes that could affect your repayment options.

Student Loan Repayment Options 2025: Making the Right Choice

Choosing the right student loan repayment plan is a personal decision that depends on your individual circumstances. Take the time to explore your options, weigh the pros and cons of each plan, and make an informed decision that aligns with your financial goals.

Remember, you’re not alone in this process. There are resources available to help you navigate the complexities of student loan repayment and find a plan that works for you.

In conclusion, navigating student loan repayment options 2025 requires understanding the different types of loans, exploring available repayment plans, and staying informed about potential policy changes. By creating a budget, prioritizing high-interest debt, and seeking professional advice, you can effectively manage your student loan debt and achieve your financial goals. Don’t hesitate to reach out to financial advisors or student loan experts for personalized guidance. Your proactive approach will make a significant difference in your financial future.

What are your biggest concerns about student loan repayment? Share your thoughts and experiences in the comments below!