Ever feel like your money’s playing hide-and-seek, and you’re always “it”? You’re not alone. Many of us struggle to keep tabs on where our hard-earned cash is going, which is why finding the best budgeting apps 2025 is essential.

In this article, we’ll dive into the top contenders poised to dominate the budgeting landscape next year, helping you take control of your finances and finally find your financial peace. Get ready to discover the tools that can transform your spending habits and empower you to achieve your financial goals.

The Future of Finance: Why Budgeting Apps are Essential

Budgeting apps are no longer just a trend; they are a necessity for anyone looking to gain control of their finances. These apps offer a convenient and accessible way to track spending, set financial goals, and identify areas where you can save money.

With the increasing complexity of modern finances, from multiple bank accounts to various investment options, having a centralized platform to manage everything is invaluable. The best budgeting apps 2025 will offer even more sophisticated features, including AI-powered insights and personalized financial advice.

The Evolution of Budgeting Apps

Budgeting apps have come a long way from simple spreadsheets. Early versions offered basic expense tracking and categorization.

Today’s apps are far more sophisticated, offering features such as:

- Automatic transaction importing

- Bill payment reminders

- Investment tracking

- Personalized financial advice

As we look to 2025, expect even more advancements, including better integration with other financial tools and more sophisticated AI-driven insights.

Top Contenders for Best Budgeting Apps 2025

Let’s explore some of the apps that are expected to be at the forefront of the budgeting world in 2025. These apps are not only user-friendly but also packed with features to help you achieve your financial goals.

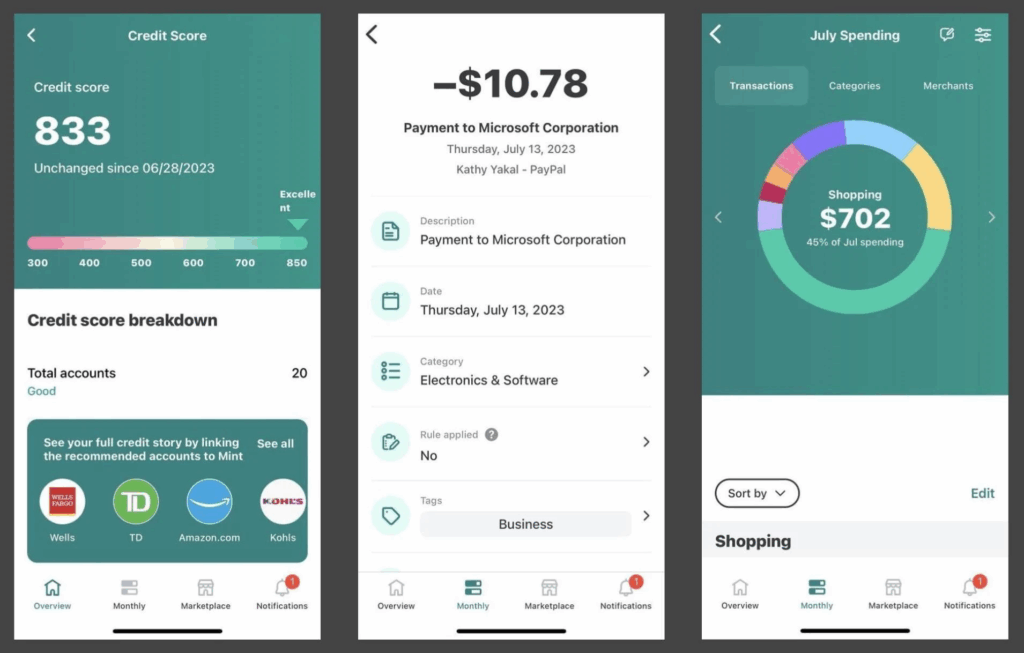

1. Mint: The Classic Choice, Evolved

Mint has been a staple in the budgeting app world for years, and it’s expected to remain a top contender in 2025. Known for its user-friendly interface and comprehensive features, Mint offers a free and effective way to manage your finances.

Key Features of Mint

- Bill Tracking: Mint automatically tracks your bills and sends reminders to help you avoid late fees.

- Budget Creation: Create custom budgets based on your spending habits and financial goals.

- Investment Tracking: Monitor your investment portfolio alongside your other financial accounts.

- Credit Score Monitoring: Keep an eye on your credit score and get alerts for any changes.

Mint’s strength lies in its simplicity and broad range of features, making it a solid choice for beginners and experienced budgeters alike. The platform’s evolution will likely include enhanced AI-driven insights and personalized recommendations.

2. YNAB (You Need a Budget): The Proactive Approach

YNAB, short for You Need a Budget, takes a different approach to budgeting. Instead of just tracking your spending, YNAB encourages you to plan every dollar you earn before you spend it.

YNAB’s Unique Methodology

- Four Rules: YNAB follows four key rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money.

- Zero-Based Budgeting: Every month, you allocate all of your income to specific categories, ensuring that every dollar has a purpose.

- Real-Time Tracking: YNAB tracks your spending in real-time, helping you stay on track with your budget.

- Goal Setting: Set financial goals and track your progress over time.

While YNAB requires a subscription fee, many users find that the proactive approach and detailed insights are well worth the investment. Expect YNAB to continue refining its methodology and enhancing its user experience in 2025.

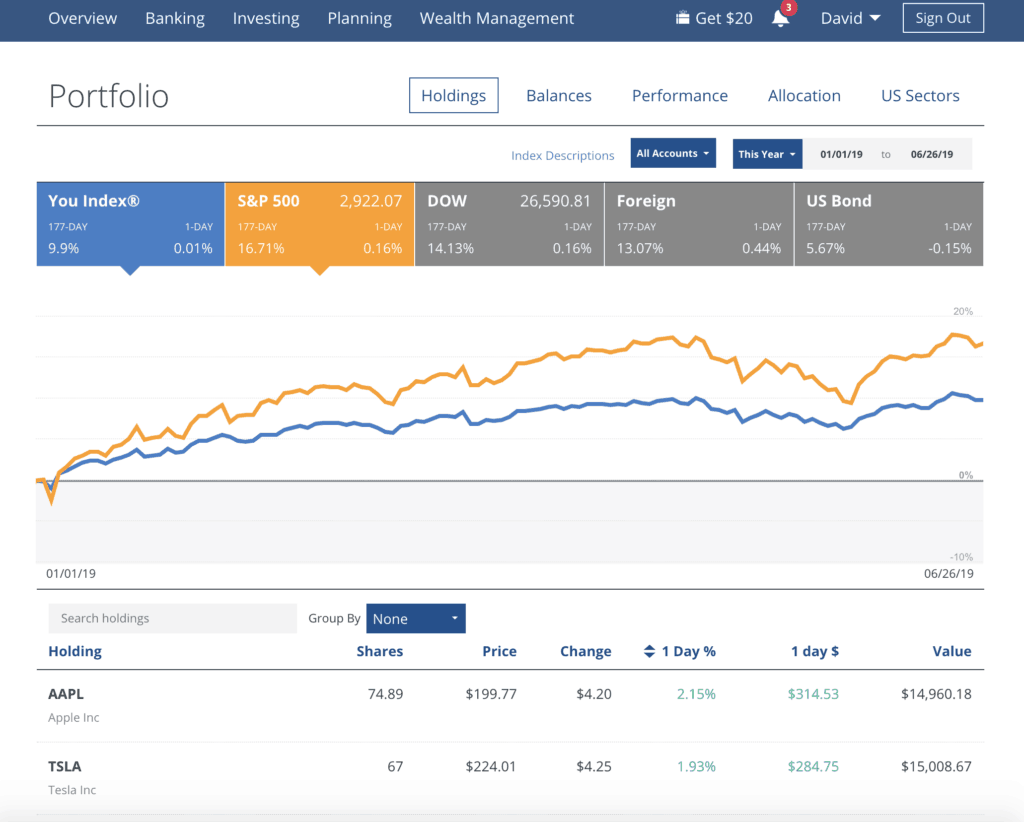

3. Empower: The Investor’s Choice

Empower is designed for individuals who want to manage their investments alongside their budgeting. This app offers a comprehensive view of your financial life, including your net worth, investment performance, and cash flow.

Key Features of Personal Capital

- Investment Tracking: Monitor your investment portfolio and track your returns.

- Net Worth Calculation: Get a clear picture of your net worth, including assets and liabilities.

- Retirement Planning: Plan for retirement and track your progress towards your goals.

- Fee Analyzer: Identify hidden fees in your investment accounts.

Personal Capital’s strength lies in its ability to provide a holistic view of your finances, making it an excellent choice for investors and those with complex financial situations. The app’s future iterations will likely focus on enhancing its investment analysis tools and providing more personalized financial advice.

4. PocketGuard: The Simple and Visual Option

PocketGuard focuses on simplicity and visual appeal. This app makes it easy to see where your money is going and identify areas where you can save.

PocketGuard’s Key Features

- Automatic Budgeting: PocketGuard automatically creates a budget based on your income and expenses.

- Spending Tracking: Track your spending in real-time and see where your money is going.

- Bill Management: Manage your bills and avoid late fees.

- Savings Goals: Set savings goals and track your progress over time.

PocketGuard’s user-friendly interface and visual approach make it a great choice for those who are new to budgeting or who prefer a more straightforward approach. As we move towards 2025, expect PocketGuard to enhance its automation capabilities and offer more personalized insights.

5. Monarch Money: The Collaborative Choice

Monarch Money is a newer player in the budgeting app space, but it’s quickly gaining popularity for its collaborative features and user-friendly design. It’s designed to help couples and families manage their finances together.

Monarch Money’s Standout Features

- Collaborative Budgeting: Share your budget with your partner or family members and track your finances together.

- Customizable Categories: Create custom spending categories that fit your unique lifestyle.

- Goal Setting: Set financial goals and track your progress over time.

- Investment Tracking: Monitor your investment portfolio alongside your other financial accounts.

Monarch Money’s collaborative features and customizable options make it a great choice for couples and families who want to manage their finances together. In 2025, expect Monarch Money to continue to refine its collaborative features and expand its integration with other financial tools.

Factors to Consider When Choosing a Budgeting App

With so many options available, choosing the best budgeting apps 2025 can feel overwhelming. Here are some key factors to consider to help you make the right choice:

1. Your Budgeting Style

Consider your preferred budgeting style. Do you prefer a proactive approach, like YNAB, or a more hands-off approach, like Mint?

2. Your Financial Goals

Think about your financial goals. Are you focused on paying off debt, saving for retirement, or managing your investments?

3. Your Technical Skills

Assess your technical skills. Are you comfortable using complex software, or do you prefer a more user-friendly interface?

4. Your Privacy Concerns

Review the app’s privacy policy and security measures. Make sure you’re comfortable with how your data is being used and protected.

5. Your Budget

Consider your budget for a budgeting app. Some apps are free, while others require a subscription fee.

How to Maximize Your Budgeting App Experience

Once you’ve chosen a budgeting app, here are some tips to help you maximize your experience:

1. Connect All Your Accounts

Connect all of your financial accounts to the app, including your bank accounts, credit cards, and investment accounts.

2. Categorize Your Transactions

Take the time to categorize your transactions accurately. This will help you get a clear picture of where your money is going.

3. Set Realistic Budgets

Set realistic budgets for each spending category. Don’t try to cut back too much too quickly.

4. Track Your Progress Regularly

Track your progress regularly and make adjustments as needed. Budgeting is an ongoing process.

5. Use the App’s Features

Take advantage of the app’s features, such as bill payment reminders, goal setting tools, and investment tracking.

The Role of AI in Budgeting Apps 2025

Artificial intelligence is poised to play a significant role in the best budgeting apps 2025. AI-powered features can help you automate tasks, identify savings opportunities, and get personalized financial advice.

AI-Powered Insights

AI can analyze your spending habits and provide insights into areas where you can save money.

Automated Budgeting

AI can automatically create a budget based on your income and expenses.

Personalized Financial Advice

AI can provide personalized financial advice based on your individual circumstances.

Fraud Detection

AI can help detect fraudulent transactions and protect your financial accounts.

Security and Privacy Considerations

When choosing a budgeting app, it’s important to consider security and privacy. Make sure the app uses strong encryption and has a clear privacy policy.

Encryption

Ensure the app uses strong encryption to protect your financial data.

Privacy Policy

Review the app’s privacy policy to understand how your data is being used and protected.

Two-Factor Authentication

Enable two-factor authentication to add an extra layer of security to your account.

Regular Updates

Choose an app that is regularly updated with security patches and new features.

Beyond the App: Cultivating Good Financial Habits

While best budgeting apps 2025 are powerful tools, they are most effective when paired with good financial habits. Here are some habits to cultivate:

Track Your Spending

Even without an app, make an effort to track your spending. This will help you become more aware of your spending habits.

Create a Budget

Create a budget and stick to it as closely as possible. This will help you stay on track with your financial goals.

Save Regularly

Save a portion of your income each month. Even small amounts can add up over time.

Pay Off Debt

Prioritize paying off high-interest debt, such as credit card debt.

Invest Wisely

Invest your money wisely to grow your wealth over time.

Conclusion

Choosing the best budgeting apps 2025 is a crucial step towards achieving financial stability and reaching your financial goals. By considering your budgeting style, financial objectives, and technical skills, you can select an app that aligns perfectly with your needs. Remember to leverage the app’s features, cultivate good financial habits, and stay informed about the latest advancements in financial technology.

What are your experiences with budgeting apps? Do you have any favorites or tips to share? Let’s discuss in the comments below!